This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

In a previous life, I briefly lived in Seattle, and I was a big fan of the city. I grew up in New Mexico, so I’ve had about as much sun as I need for one lifetime. Seattle’s rainy streets were a respite. While walking through downtown Seattle, I would often see these glass tiles embedded into certain parts of the sidewalk.

You could see through the sidewalks, though down into what I wasn’t sure. I didn’t think much of it until after a few months of living in Seattle my parents came to visit and I was googling around looking for things for us to do. That’s when I stumbled onto the story of the Seattle Underground.

After a massive fire in 1889, big parts of the city were rebuilt and the sidewalks were regraded two stories up, leaving a massive underground network where the original sidewalks used to be. That was what I’d been staring into while walking the streets around Pioneer Square.

It was fascinating that one world was built on top of a previous world, and then left below without most people even realizing it. But the more you think about it, the more you realize most of life is built on the left behind remnants of past experiences. We're all shaped by experiences that happened to us as kids, and all through growing up, but we don't often stop to think about that foundation.

The same can be said of the evolution of the stories we tell ourselves about budding technology. The hype cycles that ebb and flow impact how our narratives form going forward.

The Sine Waves of Hype

I've written so often about hype that its become a section on my personal website where I highlight the specific essays I've written on the topic. This is my hype series thus far:

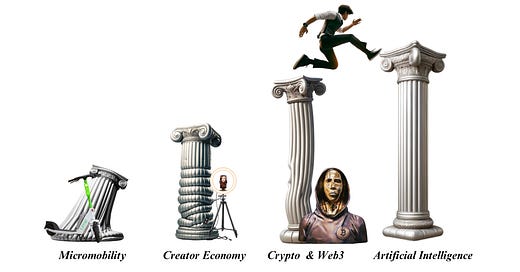

Throughout this whole corpus of exploration on the topic of hype I've highlighted categories that have come, and gone, and come again. Virtual reality in 2013 (Google Glass, Oculus), chatbots in 2016 (Intercom, Drift), meal kits in 2017 (Blue Apron), micro mobility in 2018 (Bird, Lime), web3 in 2021 (OpenSea, FTX), and AI in 2022 (OpenAI, Anthropic). We're starting to see the rising hype tide around the catch all that is American dynamism which touches on industrial categories, like aerospace, defense, manufacturing, etc.

But one critical aspect of this equation is the word "cycle." We, too often focus so much on the up, or so much on the down, but not enough on the cyclicality of it. Take VR. Google Glass was all the rage in 2013 when it first launched (and I mean all the rage!) Then it failed. Then Facebook bought Oculus for $2B+. Then they fired Palmer Luckey. Then Apple announced Vision Pro. It cycles over decades.

Fred Wilson talked last year about these types of hype cycles:

"I think these technologies kind of go in these hype cycles. We had this huge hype cycle in web3. And now we’re definitely in the trough of disillusionment and we’re in the full hype cycle of AI. And I think there will come a time when we calm down a little bit and realize we’re not gonna be working for robots in a few years."

That idea of a "trough of disillusionment” is highlighted in Gartner's Hype Cycle framework.

I think the most important takeaway from this framework is that when you look at both the highest part of the peak of expectations, and the lowest point of the trough of disillusionment; neither of them are at the level of the plateau of productivity. Neither the highest highs, nor the lowest lows represent the reality of eventual outcomes.

Often, the long-term bulls on a particular technology will even welcome the eventual downward spikes in hype. I've written before about Fred Ersham and Matt Huang, who founded the crypto venture fund, Paradigm. They've said before that when the crypto bubble popped in 2018, it was a relief:

"Both were relieved when the Bitcoin bubble burst in early 2018. Out flowed the dabblers, day traders, and daily Bitcoin price updates on CNBC. To Ehrsam and Huang, those who remained represented the more attractive long-term investments – people who would look smart and have built big businesses by the time the hype cycle swung around again."

The Truly Convicted

I think that the reason people get uncomfortable with hype cycles is because they don't like "the dabblers, the day traders," the daily updates on every little thing. And that's not just the stuff in crypto. In AI, just recently, Demis Hassabis, one of the co-founders of DeepMind, said “the surge of money flooding into artificial intelligence has resulted in some crypto-like hype that is obscuring the incredible scientific progress in the field.”

That's an OG. The truly convicted. His concern is for the scientific progress in the space. Not the hype. Not the price. Not the ability to raise, or the revenue potential. He's truly convicted of the progress in the category, and is willing to acknowledge that too much excitement can be just as damaging as not enough.

When I think about the truly convicted, I'm reminded of the story of Mark Zuckerberg turning down a $1B acquisition offer from Yahoo. Now, granted, in hindsight as Meta towers over Yahoo with a $1.3 TRILLION market cap, (compared to Yahoo getting scooped up by Apollo alongside AOL in a $5B deal) it's easy to say that was a good decision.

But at the time, Mark Zuckerberg was 22 years old, and owned 25% of Facebook. The company had $30M of revenue and was not profitable. Zuck walked into the conversation about that decision with his conviction on his chest: "This is kind of a formality, just a quick board meeting, it shouldn't take more than 10 minutes. We're obviously not going to sell here."

Peter Thiel pushed him to take the conversation seriously: "You own 25 percent. There's so much you could do with the money." Zuck's answer should be the war cry of every truly convicted soul: "I don't know what I could do with the money. I'd just start another social networking site. I kind of like the one I already have."

I haven't been able to find this from where I originally saw it, maybe a Twitter thread (so if you know what I'm talking about, send it to me). But when you look at some of the great companies over the last few years, they're almost never businesses that were built within the height of a hype cycle:

Stripe was founded in 2009 while everyone was focused on social media.

Coinbase was founded in 2012 while everyone was focused on VR.

OpenAI was founded in 2015 while everyone was focused on IoT

Anduril was founded in 2017 while everyone was focused on crypto.

Palmer Luckey is one of the patron saints of the truly convicted. In multiple interviews, he's refused to speak ill of Meta and Meta Quest, even though the company fired him, because he is still a committed believer in VR, and anything he could say critically about them could do damage to the category overall.

His latest company, Anduril, is no exception. He's been through the hype cycle ringer. In 2019, Bloomberg called Anduril "tech's most controversial company.” Palmer himself points out that this was the same year where TikTok was banning users for calling attention to the Uyghur genocide in China, or banning users for posting homosexual content. This was the same year Adam Neumann paid himself tens of millions of dollars for the right to use the word "We." It was the year Uber was under federal investigation for its workplace culture. It was the year Facebook was getting hauled in front of Congress to testify.

"But of course, as a tiny defense company making a handful of purely defensive base security systems that committed the crime of building technology for the military, Anduril was the one that claimed the belt for the world's most controversial technology company."

Nowadays, Palmer talks about going on his "I told you so" tour. A company founded in 2017, and persevered through some pretty hateful reactions, was finally vindicated when Russia invaded Ukraine and proved that the "end of history" was far from a reality.

What's more is even as other hype cycles rise, like AI, Palmer doesn't jump ship. He isn't like the Fortune 500s who were suddenly announcing their NFT plays in 2021. He embraces some of the hype, in as far as it empowers the thing he really believes in, which is building defense technology for the U.S. and its allies. He says it himself:

"I love ChatGPT, not because I use it, but because my customers all use it and that has made them believe in AI. Even though my AI has nothing to do with large language models.”

Deflation & Inflation

Hype is a physical force that deserves a place on the periodic table. The global social and economic impacts hype can have are just as powerful as oxygen or hydrogen. But just as the elements are natural forces that we can bend to our will, hype is something we all ought to have a better grasp on.

Hype comes and goes. Stories wax and wane in people's minds. Conviction, true conviction, is not born of consent.

Conviction born from the draw of hype is rarely built to stand the test of time.

Investments made in the peak of hype rarely turn out to be the best mechanisms to compound capital.

Careers bred in the throes of hype are rarely anchored in fundamental truths.

People need to understand the sine waves of hype as the energy around a category inflates and deflates. Some, like meal kits or micro mobility, were maybe never going to persist. Others, like crypto and VR, are simply being forged in the fires of hype inflation and deflation.

The most important lesson, I think, is for more people to try and build things because they believe they are true. Because they're based on true principles. Critics and champions will come and go. But conviction, banked and cooled by belief and pragmatic evaluation, can be unstoppable.

Special thanks to Molly O’Shea for having me on the Sourcery podcast this week and helping me finally articulate how I wanted to talk about this topic.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

This reminds me of the quote “Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years.”

Absolutely and some companies who are forged in the fires of hype inflation and deflation come out a lot stronger! Reminds me of the quote

"Boy, you're about to take on the full force of a star. It'll kill you." "Well, only if I die"

the truly convicted indeed!