Index Bets: From Products to People

Sum of the Parts

Every active investor across public or private companies is not only trying to make money. They're trying to beat the cheapest alternative. The bar for success is being able to say someone's money invested with you will perform better than if they just put it in a passive fund. Any Buffett disciple has seen his dramatic outperformance chart.

These passive "alternatives" are typically index funds like the Invesco QQQ that tracks the performance of the largest non-financial companies in the Nasdaq-100 Index. If you're looking to put money somewhere you can either pay 0.2% to invest in QQQ or pay 2% a year and 20%+ of the upside to a venture fund. Funds have to justify their fees.

But that isn't always very easy. Last year 80% of actively managed public funds performed worse than indexes like the S&P 500. There is some argument about returns from VC funds when adjusting for fees and a crazy bull market the last 10+ years, but even still more than 50% of venture funds underperform market indexes as well.

Why are indexes such an effective strategy and so difficult to beat? One key reason is because they're built to ride on one big wave rather than several highly-opinionated waves. An index is representative of an entire market or category. If you're building an index of something you don't have to pick winners. You just have to pick trends. As an example, the BVP Cloud Index tracks emerging cloud companies. As you can see from the performance that’s a pretty compelling trend with a great group of companies.

There are a lot of people who don't like indexing and see it as a negative force in public markets. For all active investors who are trying to have strongly held opinions and make conviction bets they don't like the idea of someone just riding the overall market. Aswath Damodaran, an NYU Professor of Finance perfectly summed up why some people don't like indexes:

“Well, let’s start out by noting that many of these people who critique indexing have a very selfish reason for doing so – it’s taking away their living. And that’s for a very good reason, which is they’ve not been very good at what they do for a living and indexing has exposed that.”

Investors charge significant fees off of the assumption they're very good at picking winners. Indexing as a strategy is a way of saying "Trend XYZ is a big thing" without having to say "I know exactly who is going to win in Trend XYZ."

Making Index Bets

One of the key aspects of indexing is that it's less opinionated; this idea of picking trends without having to pick winners. A lot of people have pointed to Tiger as building an index of private software companies, effectively saying "You are still thinking too small. We are earlier than you realize, and winners will be orders of magnitude larger than we currently believe." Regardless of whether or not you agree with them, that's their strategy (even if their own conviction in it wavers here and there). But it's definitively less opinionated than most VCs who are convinced their bets are the only logical winners.

Beyond just building a basket of companies to represent a trend there is also the opportunity to invest in specific companies that represent an index in and of themselves. I've written before about Elad Gil's article on "index bets" when it comes to investing in companies.

"One lens through which to view companies is to ask "what companies are an index of their underlying market"? Index companies often take a cut of every transaction in their space, or are a piece of infrastructure everyone in the market needs. These companies may be ways to participate in the market broadly without having to worry about who wins in it."

Companies like Stripe, Coinbase, or Nvidia have become ways to bet on digital payments, crypto, and AI without having to know who the right winner is. When you think about necessary infrastructure you have companies like Twilio for communications, Plaid for banking data, Check for payroll data, or Cohere for NLP. These companies will be successful as long as there is increasing demand for the underlying data infrastructure they provide.

The most important question in evaluating an index is understanding the underlying trend. You can build an index of companies selling fax machines and camera film, but you probably won't do so well. Stripe is a successful index bet because digital payments has exploded and continues to become increasingly important. It's also given them direct access to every other adjacent category to online payments.

There are a lot of interesting ways to invest in companies as index bets on particular markets or technology. But one of the things I'm most interested in these days is finding index bets on people.

Building a Community Index

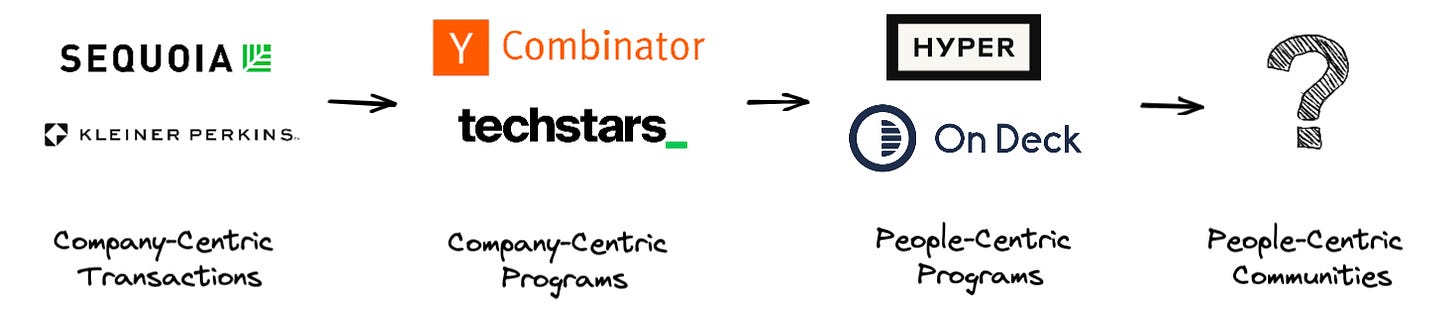

There has been an evolution in the way VCs identify and build relationships with companies. The traditional venture model is find companies and give them cash. YC pioneered a way of finding and supporting people with ideas. OnDeck and others have started to run programs for people even if they don't necessarily have an idea, and then have expanded into the YC-esque company-focused accelerator programs.

But there are still some limitations that stop these approaches from becoming true indexes. YC is still fairly opinionated. Think about the misses they've had because they had to make a judgement call on whether they thought the opportunity would be big.

Don't get me wrong, YC has done a fantastic job in building a portfolio. But the world is changing faster and faster. We're on internet time and the words of Ferris Bueller have never been more true. The power of a people index is building decentralized nodes of speciality. In other words? I don't have to be the smartest person in every room. I just need to know how to identify the smartest person in each room.

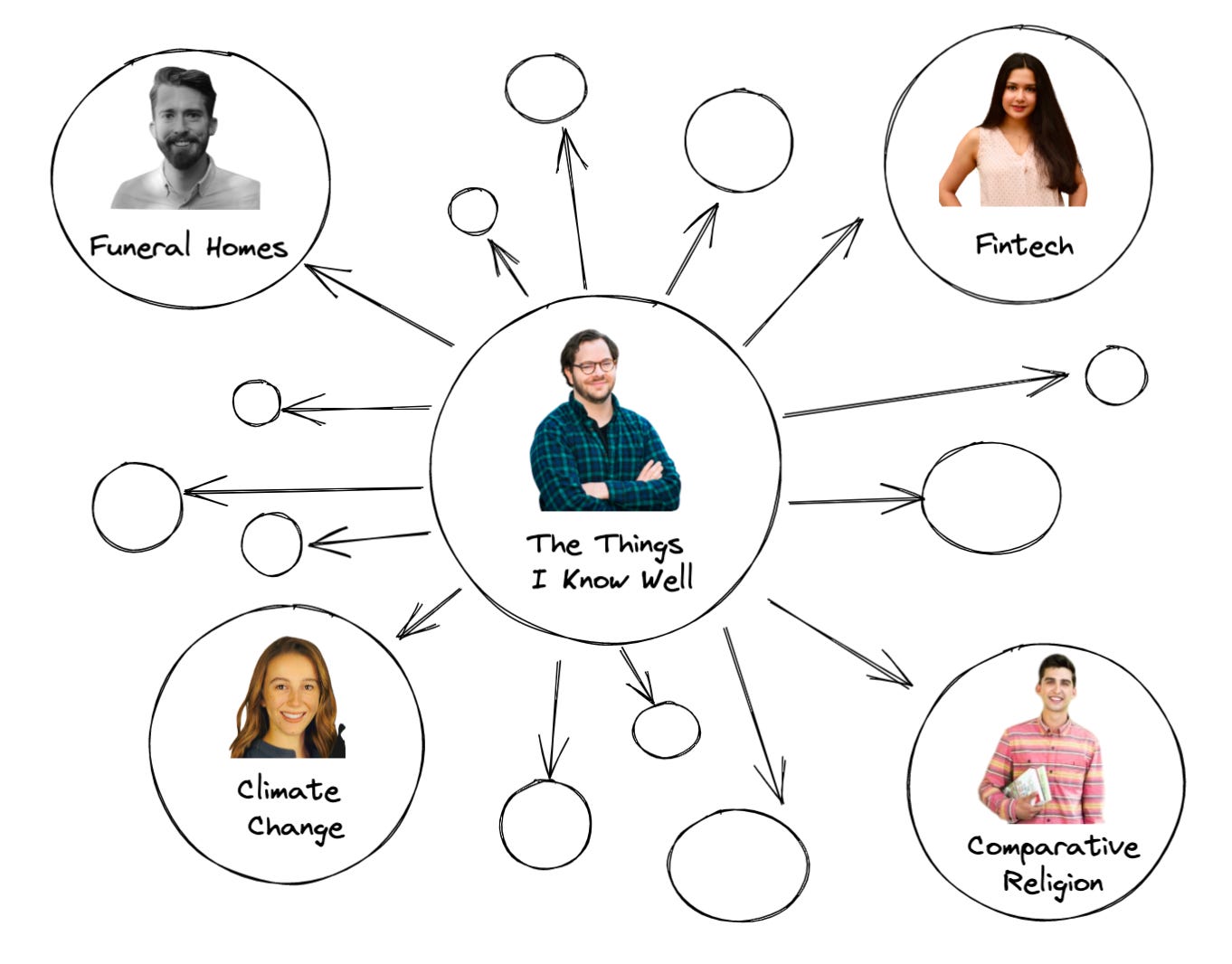

For a long time I've had this idea of a decentralized brain. Basically the idea that I can't know everything, so I should know people that know things I may need or want to know about.

Not everyone agrees with this idea. I once had a friendly debate with Pat Grady about whether you can know everything. He pointed to the idea of building a latticework of memory to keep all types of information in your head without having to rely on other people. Certainly some value to this idea. Even Charlie Munger tends to dismiss reliance on other people for your thinking.

"If, in your thinking, you rely entirely on others, often through purchase of professional advice, whenever outside a small territory of your own, you will suffer much calamity."

But the idea of a decentralized brain doesn't remove your responsibility for having your own thoughts. It acknowledges a simple reality that Tom Nichols describes in his book, The Death of Expertise:

"No matter what our aspirations, we are bound by the reality of time and the undeniable limits of our talent. We prosper because we specialize, and because we develop both formal and informal mechanisms and practices that allow us to trust each other in those specializations."

So as an individual you can dramatically increase your odds of understanding and taking advantage of all the exciting things getting built in our increasingly complex world by establishing a decentralized brain. The process and methods to build that network are fodder for another day and another post.

The concept of a community index comes in because, as an individual, you're quickly confronted with Dunbar's Number. This idea that, as an individual, you can only maintain ~150 meaningful relationships at any time.

There is so much complexity in the world that no one person can maintain adequate nodes to even scratch the surface of the most interesting things getting built That rate of complexity is only going to increase as technology continues to advance rapidly into everything from direct carbon capture to stablecoins. No one can understand and identify all the best things. Community indexes, if built correctly, can take the concept of a decentralized brain and scale it effectively without running into the limitations of an individual's mental or physical capacity.

Examples of a Community Index

Synthesis

I wrote last week about Synthesis and how they're building "Ender's Game for innovators." Synthesis started what will eventually be the overhaul of the entire global education system with a simple first step. Multiplayer games to teach students good judgement, sense-making, and collaboration.

As they've scaled Synthesis has let more and more people off their waiting list with the goal of making their games accessible to everyone in the world. But their long-term vision is to build a community of the most exceptional kids who are most capable of tackling the world's most complex problems.

"Our goal is to make Synthesis available to every child in the world. But our first commitment is to the top 1% by cognitive ability and commitment. Our current system is cutting off the runway for our most advanced students. We believe in doing the opposite—challenging these students as much as possible so that they build the capabilities to solve big problems for all of us. Education is a positive-sum game."

Some people might jokingly point to Ender's Game as a bit dystopian of a reference for a children's game but it’s important to step back and remember the current educational system is more like the Hunger Games. Chrisman Frank, the CEO of Synthesis compares their approach to European soccer clubs. "Just as there are recreational soccer players, there are recreational Synthesis players. But if you want to move up, the option is available and there is no speed limit."

That's how Synthesis is a community index. They've built a scalable system in offering a game that effectively identifies the most committed and cognitively-capable students. Arguably Synthesis can do this more effectively as a community than any individual could because they can avoid bias. A child might stand out as part of Synthesis regardless of whether they're going to Phillips Exeter Academy, working on a dairy farm in Poitou-Charentes, or selling solar lamps in Kampala.

Replit

Replit also came up in my article last week because Amjad Masad, the CEO of Replit, co-led Synthesis' $12M round. Amjad points to a critical vision where Replit and Synthesis are perfect complements.

"Computers give humanity the power to solve some of the most critical problems our species has ever faced. However, until today, we have failed to leverage this unprecedented tool; we teach kids to be mere consumers of this powerful machine. To change this, society needs three things: (1) access to the tool, (2) education in the complex skills necessary to use it, and (3) education in the problem-solving skills necessary to maximize the potential for human progress. At Replit, we’re making computer programming accessible and learnable for anyone, no matter their background, location, or socio-economic status. That covers points 1 and 2, but what about point 3? We need a way to offer any kid from anywhere the opportunity to learn collaboration, critical thinking, and problem-solving so they can capitalize on the promise of computers. [That's where Synthesis comes in.]"

Amjad often tells the story of growing up in Jordan and, while learning a bunch of different programming languages, he would have to pay for time at an internet cafe. What started as a way to avoid having to spin up his programming environment from scratch grew into a mission to "bring the next billion software creators online."

Replit has grown to over 10M users and, as a product, attracts a "lover of the game" type of builder. They're not focused on robust enterprise features to solve for the "software development grind."

"Repl.it is not a tool for building large-scale software. It's not for your legacy codebase. Repl.it is a tool for experimenting with new ideas. It's for being creative."

In a deep dive on Replit that Packy McCormick did he described Replit's unique ethos as the result of feeling like a toy.

"Replit wants to build the future, and to build the future, you don’t rebuild the old thing for the old customers. You build something new that starts out looking like a toy, and you build for the underserved, not just for moral reasons, but for strategic ones. It’s disruptive innovation meets the compounding power of young users. It’s more Roblox than Github".

But the result of the vibe and functionality that Replit offers is the perfect combination to become a community index. Replit has even started to try and offer capital to the builders in their community by launching things like Replit Ventures.

"Our applicants included both teenage hackers in India and Senior SWE's at FANG companies. (The younger entrepreneurs were always more innovative btw)."

Replit has an unfair perspective on millions of builders based on their ability to see what people are using their product to build. And as they scale to millions more they have a number of opportunities, including Replit Ventures, to ride that wave without needing to pick who the best builder on their platform is.

Stripe, TikTok, and on and on

There are countless other indexes worth thinking about. Stripe who, in addition to being an index bet on digital payments, is making an index bet on their people. Between Patrick and John Collison and Stripe directly they've invested in almost 100 companies, many of them founded by Stripe alumni. Their talent funnel has given them a unique index on high quality people. TikTok launched their Creator Fund that quickly grew in expectation from $200M to $1B. Their unique vantage point as a creator platform gives them the ability to build an index around the highest quality content producers and then they can more effectively back those creators to increase the quality of the overall platform.

What Does This Mean For Venture?

VCs are dramatically more opinionated than any index. "Everything in my portfolio is a generational business while everything in anyone else's portfolio is over-valued vaporware". But those opinions often come from an over-trusted gut that is largely informed by the same 20 people they trust (their "boys club.") This over-trusted gut is one (of the many) reasons so little funding goes to women and people of color. If your trusted network of gut-informers includes 19 white dudes you went to Stanford with then you're unlikely to get a nuanced perspectives on women's health or banking for immigrant communities.

Don't get me wrong, I'm not a proponent of just index investing in private companies; venture capital is an outlier business and picking is a critical skill for any investor. What I am saying, instead, is that VCs can improve their decision making inputs and mechanisms by identifying community indexes. I've written before about how great companies start by building talent vortexes and, if they're successful, eventually evolve into tech mafias. But identifying talent vortexes isn't the same as building a community index.

Building a community index isn't just a top of funnel mechanism. If Replit thought of their millions of creators as a simple means to an end but focused all their time, attention, and features on the "end," they would quickly frustrate and strangle the top. A community index needs to be a product in itself in order to scale. As a venture investor you need to identify the members of that community index and treat them like they're just as much of a customer as your portfolio founders.

Supporting a community index means you're building products for these people that enable them to achieve their goals in life by participating. If its a talent network or an operator group or an angel syndicate -- whatever it is. The members of the index have to feel well served by what they're receiving. And then you have to figure out a way to capture value. Whether that's Synthesis inviting their best students into a new class, or Shopify investing in (or buying) the companies that most serve their ecosystem. You're not only enabling the network within the index but you're also putting in place a mechanism for you to capture that value that gets created.

As the world continues to become more and more complicated VCs will frequently find themselves feeling like a 62-year old partner at a 50-year old venture firm trying to understand dogecoin unless they build community indexes of the best and brightest.