Renegade Spotlight: The General Partnership

Renegade Spotlights

The world of venture capital is changing dramatically. And it continues to change more and more quickly. We're on internet time now. Venture capital is an industry that has been fairly stable for the last 50+ years. Now every year we see any number of forces that could dramatically change how capital is allocated to startups.

I've dubbed the people driving those changing forces as "renegades." I've laid out some of the characteristics of the renegades of venture capital as I've studied them. These aren't just solo capitalists or startup funds. Any fund or investor who is disrupting the status quo in venture and aligning their offering to optimize for a founder's needs and odds of success can be a renegade. One of my favorite things is to reflect on the impact these people are having. I'm young enough in my career that I welcome radical change. It shakes up the way startups get funded and how companies get built.

In the past I've written about firms that I see as renegades. Firms like Homebrew, Lowercarbon, and Paradigm. When I see investors executing on new ways of disrupting venture I want to think publicly about what this means for the broader venture capital ecosystem.

The Renegade: TheGP

In 2018 Dan Portillo left Greylock after having spent 7 years as a Talent Partner. He'd joined from Mozilla where he grew their talent team from 20 to 300+ and saw first-hand the impact high quality talent can have on a company.

Soon after leaving Greylock he honed a different model of contributing to a company's success beyond writing a check and launched Sweat Equity Ventures. While they raised a $30M pool of capital none of that money would go into purchasing equity from startups. The cash all went in to paying for operating expenses within Sweat Equity Ventures (SEV). When a company offers equity to SEV they don't just get a casual service offering as one-of-many things out of their venture investors.

"We give founders what they often cobble together from a collection of consultants, advisors and the services arm of VC firms - but with a dedicated team with a proven track record and established working relationships, clear deliverables, and real skin in the game.”

Where at Greylock Dan would maybe have an annual budget of $2M to spend on talent across the whole portfolio he could now spend $2M on a single company out of this pool of capital. Dan worked alongside companies like Coda, Grafana, Finix, and Ubiquity6 as part of SVE. While working with Ubiquity6 he met Phin Barnes, who was also an investor and board member at the company from First Round.

Phin acknowledged the way the venture ecosystem was changing and forcing investors to be more reactive vs. building long-term working relationships. This wasn't the kind of close-partnership he and Dan preferred with the companies they worked with. So when Phin left First Round in 2020 a new partnership was born. The General Partnership.

Sweat Equity Ventures evolved into The General Partnership (TheGP) and continued to build on the foundation they had already laid. The core idea would revolve around making measurable contributions to a company’s success. Not as an afterthought, but as the core model.

The Innovation: Adding Value

Every venture firm points to some kind of value-add they want to offer. I've written before about how a lot of firms "product offerings" feel like shopping for candles. At the end of the day its just wax and scents.

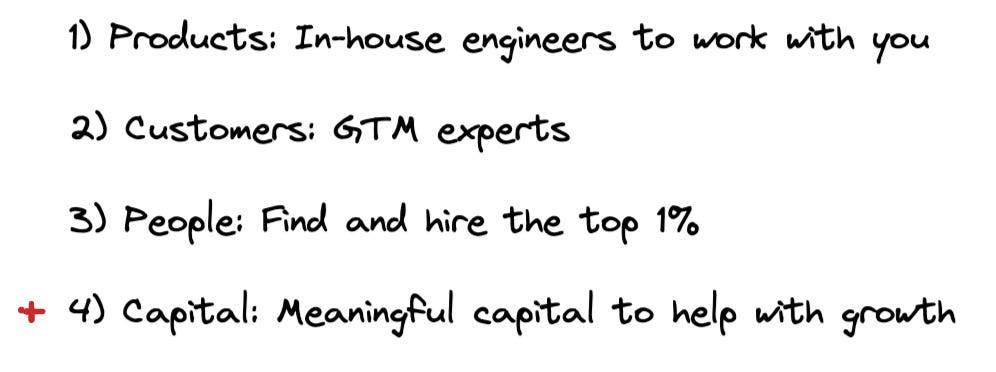

TheGP has structured itself around four key pillars. The first three were the priority when they were Sweat Equity Ventures. The fourth was added after they recently raised their first $240M fund to invest directly in the companies they work with.

TheGP's roots coming out of the SVE experience was this idea that we can focus on allocating the resources we have to offering a great product vs. just having the largest fund to write the largest check. Their first $30M pool of capital went to paying engineers, recruiters, and GTM experts who would all work in-house at SVE and then plug directly into the companies they work with.

Today the same core team of experts supports the portfolio companies at TheGP. Given Dan's background in talent its no surprise that talent has been a huge piece of what companies have benefitted from. One company has worked with TheGP to hire a head of engineering, head of product, chief resource officer and several engineers so far. But they’ve expanded successfully into closing large enterprise customers and saving companies years in engineering time with the people TheGP provides.

What is so unique about this model is that TheGP is only making a handful of investments per year and with each company they lay out a specific roadmap for what a successful relationship looks like. No venture fund lays out as clear a path forward as that, they typically just have a laundry list of things they could "maybe possibly hopefully" do for you.

"There's no fund that I know of that will write a statement of work that commits to: We will ship this product, we will hire these people, we will work with you to secure funding. It's very deliverable-based." (Dan Portillo)

And this isn't a "standard roadmap," these are bespoke agreements with each individual company to lay out exactly what they expect from working with TheGP. There's no better indicator of a product-led and customer-obsessed investor than someone like Dan who says, "I’ve always considered meeting founders’ needs as our northstar." When someone's product revolves around value its usually much more measurable.

The Value-Add Audit

I've been fascinated by this idea of a "value-add audit." There is no real tangible way to do this today, which is shocking to me. When you consider the fact that we've invested over a trillion dollars of venture capital in the last 10 years and there isn't a very clear attribution model of dollars to success? That's insane.

It's very difficult to measure the attribution of dollars to "value created" in aggregate within venture. Its much more possible if you look at isolated investments, though that's something very few funds do. What is fascinating about TheGP is that they have to do it with each investment when they lay out their "statement of work."

“One of the things that founders say is that there’s no VC that can make your company, there are only VCs that can break your company. I think that TheGP is definitely challenging that adage, because they are actually side by side with each of their portfolio companies, doing the actual dirty work that it takes to build the business.” (Richie Serna, CEO of Finix))

Once you have people who can clearly say, "well I know we hired these specific people, or launched these specific products, or closed these specific customers because of TheGP," the ability to attribute value-add becomes much more clear.

The Economics of Value-Add

The majority of the relationships TheGP has are structured so that services are offered in exchange for common stock that vests over a value-aligning schedule, just like an employee would have. Their equity is aligned to key metrics where they focus to add value, which is much more concrete than the typical "roll-of-the-dice" most founders have to endure with traditional VCs.

With SVE's first pool of capital they had $30M that went towards staffing experts on the team that could plug right into portfolio companies. They've now deployed ~$66M in “operational capital” and beyond the cash they have on-hand for operating budgets they also offer each member of the team a portion of the economics from the equity they have in their portfolio companies.

So who are the people driving all the value that TheGP is offering?

The Unbundling of Venture Capital

TheGP calls their team of 25 full-time experts "The Builders."

"Our Builders have built some of Silicon Valley’s most iconic products, from Google’s Knowledge Graph to YouTube’s infrastructure to Redfin’s marketplace model, and scaled teams at companies like Stripe, Robinhood, and Uber from their earliest stages."

When you look at the caliber of people working within the functional pillars at TheGP these aren't just casual participants. These are seasoned experts.

Talent: Anthony Kline who was the Head of Executive Recruiting at Stripe for 3+ years or Dino Lamela who was the Director of Global Talent at Databricks for 6 years.

GTM: Ross Wiethoff who was a Head of Sales at Square or Danny Oliveri who was a VP of Enterprise Sales at Oracle

Product & Engineering: Stas Baranov who spent 12 years as a Staff Tech Lead Manager at Google or Sasha Aickin who was the CTO at Redfin

I've written before about the unbundling in venture but I focused a lot on the individual brand of the investors. But it's much bigger than that, extending beyond investors to all the phenomenal operational talent working within venture, many of whom are dramatically under appreciated. I called it the "Magna Carta Moment" for talented people working in traditional venture firms:

"You often see the monolithic brand mothership [venture fund] start to crush the spirits of highly qualified [people]. They're frequently treated as second-class citizens. For a lot of these people they'll eventually reach a breaking point and they'll either look for a firm acknowledgement of their own value (their own Magna Carta) or they'll strike out on their own."

When I look at some of the talented folks TheGP has been able to attract, they're likely there because if they went to work for any other venture firm they would be second-class citizens. But at TheGP they're front-and-center. They are the business model.

The unbundling of venture doesn't always mean you strike off on your own to start something net new. You're starting to see firms like Long Journey Ventures that describe themselves as a "federation of angel investors and operators." Firms like TheGP act almost as a "business-in-a-box" for talented operators who want to work alongside companies without needing to build up a firm around themselves.

“In venture, there’s the investors, then there’s everyone else. And here [at TheGP], there’s us, and then there’s an investor." (Dan Portillo)

Models that put experienced operators front-and-center will continue to have outsized success in the game of creating a "product with a clearly defined value-proposition."

What Does This Mean For Venture?

The current market correction certainly impacts the amount of capital that is available, there's no question about that. Some people are talking about the shifting power dynamic away from founders and towards investors. Some of that is good news (we should really all be doing more due diligence than we've been doing) and some of it isn't power, its reality. If public companies are struggling to become more than $5B+ companies then no one wins if we keep valuing private companies a lot higher than that.

But the reality is that starting a company has gotten a lot cheaper. Founders are a lot more thoughtful about how they build their companies, how they protect against dilution, and what they actually need to build a large and successful company. So just because there is less capital doesn't mean the best founders are just going to accept onerous terms from useless VCs.

Firms like TheGP are forcing quantifiable value-add to the front of the conversation and having meaningful success. The playbook for building great companies is getting more and more established. So founders are going to start focusing on what can actually move the needle for their companies. The more VCs can articulate their "work plan" and "value-add KPIs" the better they'll able to work with the very best companies.