This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Sort of a heavy place to start for a venture capital blog, but we're gonna get into religion a bit today because I can't stop thinking about the psycho-religious dynamics that exist in funding hype in general, and AI specifically right now. So stick with me, I promise this isn't a preach piece.

When I was 19, I went on a religious mission for The Church of Jesus Christ of Latter-Day Saints. Most of my day consisted of knocking on doors and talking to strangers about Jesus. I met a lot of wonderful people, but I gotta tell you, I never realized how much people enjoy yelling at strangers.

I'll never forget a sunny summer day in Waynesboro, Pennsylvania when I passed a woman on the street and I said, "Hey, hope you're having a great day!" She took one look at my black name tag and said, "Who can have a good day when you belong to a cult?" I was still relatively new as a missionary, so I didn't have a witty retort or a resounding rebuke. I just said, "...what?" And without even pausing her stride, she walked right past me, and borderline screamed, "Your parents should be arrested for child abuse for raising you in a cult!"

Tough crowd.

I think about my mission a lot because it was the most dramatic point in my life where my appearance allowed people to immediately formulate everything they thought they needed to know about me. They already had a pre-programmed framework for what they thought of people like me.

And my job every day was to tell them they were wrong. It was just an endless stream of interactions back and forth. Confronting people's perspective and trying to re-inform them.

The reality of religion is that it has shaped so much of society's disagreements, basically forever. Religion has been the dominant psychological framework by which people decide what they believe, what their values are, and how they'll live their life. And for some reason, that framework has been accompanied by an intense need to bring other people into uniformity with our own framework.

As people increasingly become "religiously unaffiliated," they look for identity elsewhere. And the attention economy is a perfect opportunity for availability bias to kick in, allowing a big part of our personality to be dictated by hype.

Another way to describe identity-defining hype? The current thing.

The Current Thing

A lot of people have talked about the new meme of "the current thing.” Though probably no one more than Pmarca.

Basically anything that begins to feel like there is social pressure for you to believe in / support / evangelize. So many of the examples of the (previously) current things are political, so I won't go into them. But the phenomenon is incredibly instructive for hype psychology.

Erik Torenberg shared this insight:

"Current Things always have elements of truth to them, otherwise they wouldn’t capture the world’s imagination. If they didn’t contain at least some kernels of truth, they wouldn't resonate. That said, there is also often something “off” about The Current Thing as well. If it were so obviously, incontrovertibly accurate, it wouldn’t go viral, since everyone would be convinced already. There’s no need for evangelism when everyone is already converted."

People often start to shape their identity around their in-group beliefs. This obviously happens in politics and religion. But I would argue this happens in almost every group. Every group has their "current thing."

Think about the story of Redditors short-squeezing Gamestop, Robinhood siding with "the man," and Ken Griffin getting back at the internet nerds by buying their copy of the Constitution. That was a fascinating piece of my in-group Current Thing lore. But basically no one in my family or religious circles knew about it.

From anecdotes like Gamestop or ConstitutionDAO you see principles arise within the group. How do you feel about pay-for-order-flow? How do you feel about billionaires and hedge funds having so much influence over outcomes that they're involved in? Each anecdotal experience that a group goes through together further solidifies the things that define being a member of that group. Whether you like it or not.

Our tribal brains have a really hard time breaking with the group. As a result, it becomes more and more difficult to be skeptical, hesitant, or doubtful. The same thing happens in religions when they shun the non-believers. In the investing world, you look at the number of times in hype-cycles that Warren Buffett has been called "out of touch." It's like clockwork. 1999, 2009, 2020. Or Bill Gurley having to endure criticism for being skeptical of the seemingly infinite supply of bull market as far back as 2016.

There is an correlated relationship between the volume of hype and the courage it takes to be skeptical. The louder the in-group gets, the harder it is to speak up against it, even constructively. I've written before about the hype cycles of venture capital, and more recently on the AI hype cycle. A few weeks ago, Eric Newcomer posted a similar reflection on AI hype, and I agree with his sentiment:

"I don’t want it to sound like I’m getting pessimistic about this artificial intelligence wave — I’m not."

Instead, my thinking has revolved not around AI. But hype in general. And more specifically, AI hype.

A Fervor of Artificially Intelligent Proportions

You could say the "current thing" in tech is AI. Everyone is talking about it, building it, building with it, or shorting stocks that aren't building with it. And again, I fervently believe in the transformational power of the technology. So much more than I ever bought into cryptomania of 2021. But I can't help but feel nervous about the hypey vibes in the space, regardless of the power of the technology.

There are three things that I find myself thinking about most often lately: (1) the fear of hype in general, (2) the actual opportunity that exists in AI, and (3) what should I be doing as a result of all of it? So let's take them one at a time.

An Acute Hype Allergy

First, as it relates to hype in general. I can't help but wonder when hype has paid off. Some massive shifts have happened in technology that have created immense value, and those are usually the platform shifts that everyone talks about. The internet, mobile, cloud computing. Then there is micro-hype about specific categories, many of which have yet to materialize: micro-mobility, creator economy, metaverse, web3.

Tons of value has been created in dozens of categories. Again, I’m not a tech skeptic! It’s a question of when the psychology causes a multitude of sins that could be avoidable.

Yesterday's Fortune Term Sheet had a great piece about proptech, another hypey category that a lot of people have been excited to invest in. One section really stuck out to me from an interview with Jeffrey Berman, a real-estate focused VC:

"In Berman’s view, 'many businesses in our ecosystem, I would argue, are good businesses, but not venture appropriate,' he says, given that they lack the high growth prospects that VCs like to see. Yet VCs have nonetheless been excited by the space in recent years, as I wrote about last summer. Proptech 'had a light shone on it,' says Berman. While he believes that spotlight is deserved considering real estate is the largest asset class, 'at the same time, you have this misunderstanding I think for many entrepreneurs and even venture capitalists' that overestimated how 'quickly something could scale in an industry that typically has not been quick to scale.'"

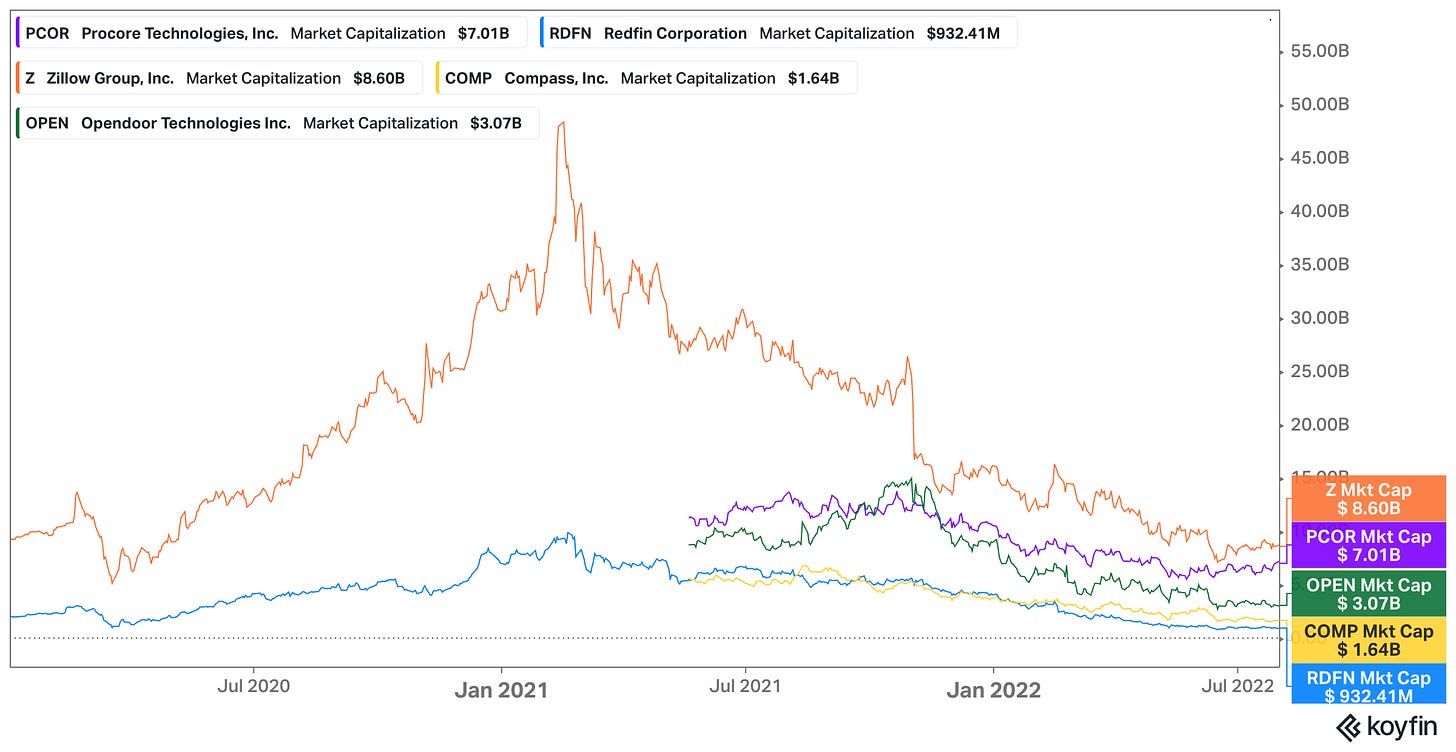

Proptech startups raised $32B of venture capital in 2021. You can certainly point to Airbnb holding value at $75B while other tech companies fall around it. But look at a lot of the other names in proptech: Compass, Opendoor, Zillow, Redfin, Procore. Just in that list of companies you have billions raised, but the outcomes are ~$7-8B in the best case scenario. Other times, you have companies like Compass with a market cap as high as all the capital they've raised. Or worse, you end up like WeWork.

Here's an important distinction: building a multi-billion business with hundreds of millions of dollars is incredible! I think Procore is an exceptional business, and I'm excited to own stock in it for a long time. My wife and I use Zillow as much as we use Instagram! Passing judgement on venture hype is not the same as passing judgement on the underlying business.

Instead, I find myself reflecting on the dynamics that exist in modern venture capital that are driving hype so fervently. 2021 isn't dead. It lives on in each of us. But it's also living on in some of the rounds we're seeing get done. In the last few months, we've certainly seen mega-rounds from established companies like Stripe (albeit a rocky process), as well as massive rounds from AI startups (more on that hype later). But today, in the year of our Lord 2023, we're still seeing rounds for fairly traditional SaaS companies get done at 100x ARR.

I've written before about how dangerous it is for these massive valuations. Here's the example I use all the time.

Let's say you have a company with $5M in ARR. They're growing quickly, have a great thesis on an interesting space. You invest $50M at a $500M valuation. 100x ARR. You now own 10% of that company. Let's assume you want to see a 3x return on that money. Let's assume the business can trade at 10x revenue. To get you a 3x return, you need a $1.5B outcome, so the company has to get to $150M of revenue.

There are so many things baked into that making it complicated. To go from $5M to $150M of revenue, will they have to raise more capital? That means dilution to your ownership, so you need to put in more capital and increase your needed outcome. Trading at 10x revenue? Right now the 5 most highly valued companies are trading at 10x, while the median is at 5x, so if your company is average and that stays the same then you need a $3B outcome instead.

My fear is that we've learned almost nothing from 2021. Venture funds have become massive and, as a result, they'll put massive amounts of capital into businesses with slim chances of becoming massive outcomes in hopes of backing the one multi-bagger, even that means backing founders who literally lit billions of dollars on fire, now in pursuit of luxury real estate with saltwater pools and dog valets.

The Implications In AI

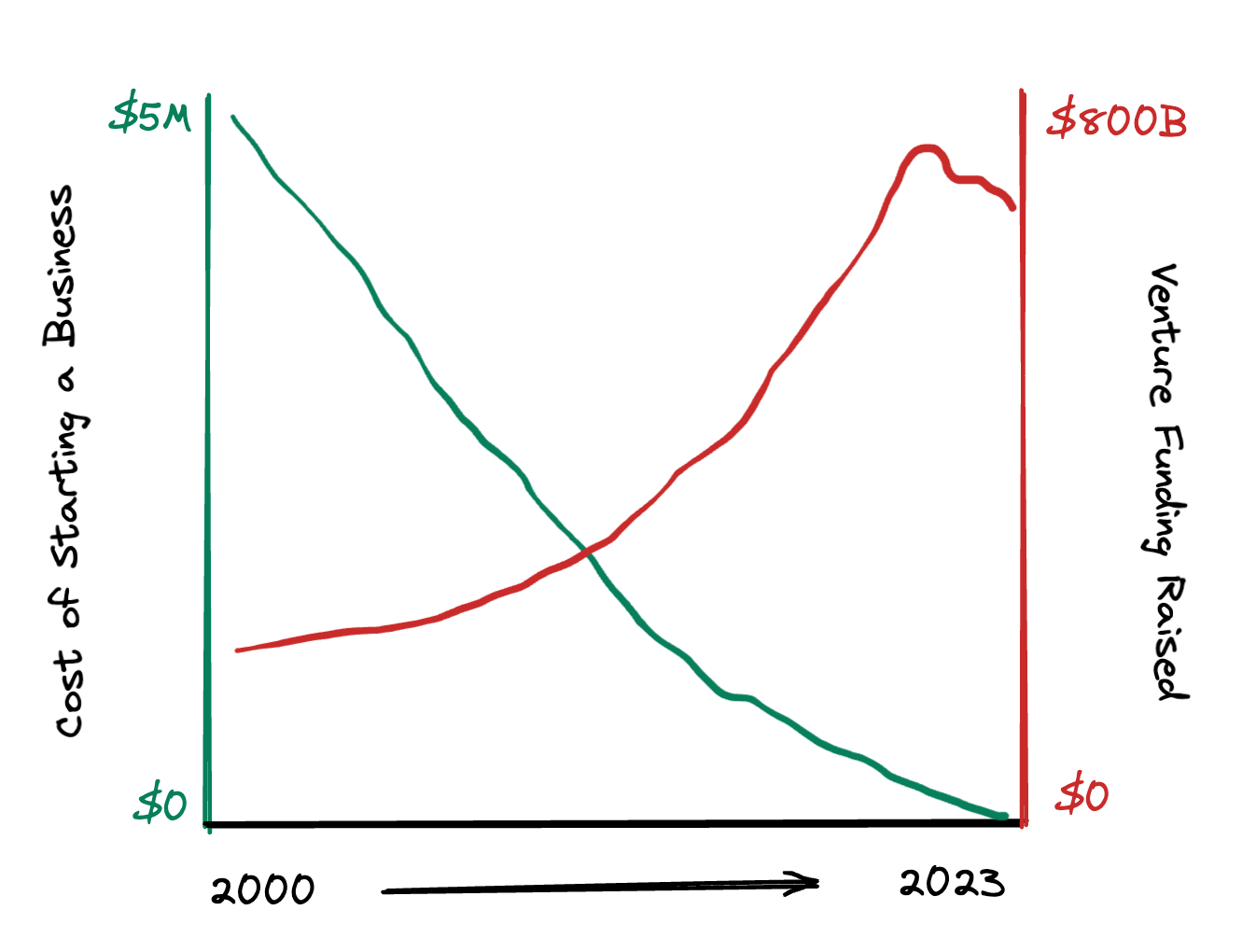

Speaking of massive amounts of capital, that will also be a big driver in how it seems AI will play out if we keep playing the exact same game. Think directionally about two numbers: (1) the cost of starting a business, and (2) the amount of venture capital that has been raised.

I don't think we talk enough about the concept of "parking capital," but its basically how capitalism works. When I talk about the business model of venture capital, I'm attempting to explain how most large venture firms are thinking. If you're managing tens, if not hundreds of billions of dollars, you're not looking for the same kinds of returns on that capital as a typical venture fund. You can afford lower returns because you're putting more capital to work (aka parking).

When I thought about a16z's $350M investment (their single largest individual check) into Adam Neumann's Flow, and both a16z's and Adam Neumann's very public courtship of Saudi money, capital agglomeration was the reason that made the most sense to me. Here's a firm whose main focus is on aggregating as big a pool of assets as possible. Here's a guy whose proven he can take on massive amounts of capital in pursuit of a big vision. Here's a source of capital that has proven it is borderline infinite. If the startup goes to zero? That's 1% of a16z's AUM. But if it hits it big? They have a residential real estate play that can scale, eat tons of capital, and maybe drive massive returns.

We used to talk about Tiger playing a different game, but I'll tell you what. Capital agglomeration is the real new game in town. And here's how that fits into AI.

Thus far, we have a field that has demonstrated it can produce massive, universal scale and applicability. ChatGPT went from 1M to 100M users in two months. It also has a massive appetite for capital. Anthropic, an OpenAI competitor, wants to raise between $3-5B in the next 2 years. Meanwhile, Sam Altman believes OpenAI may raise ~$100B over the next few years.

But this feels different than just another platform shift. AI represents a paradigm shift. The cost and complexity of AI will disproportionately benefit incumbents with data, capital, scale, and compute resources. That's why OpenAI isn't just any other startup. Raising $10B from Microsoft is a very different game than the "lean startup" iterations of yester-year.

AI seems to be pushing towards big tech concentration, with OpenAI + Microsoft and Cohere + Google, and a host of other relationships. It reminds me of industrial consolidation. The car was a huge opportunity for human progress, but not necessarily for every car company. 95% of car companies failed. It's the same thing with oil companies. Even when they broke up monopolies like Standard Oil, they couldn’t help but start to concentrate again.

When you have powerful, world-shaping technology that isn't new to everyone, but rather has monopolistic powerhouses vying for its outcomes, you're going to have power vacuums sucking up as much of the space as they can.

So you have an unstoppable force of reality-altering AI, and an immovable object of capital agglomeration screaming towards each other. Candidly, I think they're a match made in heaven and they're going to shape the world. There are oceans of consideration across AI safety, universal basic income, misinformation, AGI, and on and on. Who knows how all of that will play out?

Caught In The Middle

But what does seem to be the case is that a huge majority of startups, and even venture capitalists, are caught in the middle of these behemoth forces. And my fear is that the hype from a very different game will poison the dynamics of company building and funding.

The imbalance of capital needing to be deployed and the cost of building a business has never been greater. Going back to Bill Gurley's call for skepticism back in 2016:

"Never in the history of venture capital have early stage startups had access to so much capital. Back in 1999, if a company raised $30mm before an IPO, that was considered a large historic raise. Today, private companies have raised 10x that amount and more. And consequently, the burn rates are 10x larger than they were back then. All of which creates a voraciously hungry Unicorn. One that needs lots and lots of capital (if it is to stay on the current trajectory)."

If 2021 was the year of the hungry-hungry Unicorn, then going forward the lesson that founders could take away is that less is more. AI is already writing whole functions of code, debugging processes, and outlining hosting infrastructure. As the AI overlords and capital barons at the top duke it out, the technological advances trickle down and decrease the cost of doing anything: code, content, creativity, and everything in-between.

But the fear is that founders and funders alike will fail to appreciate the new paradigm. For a lot of ambitious people, they look at the big dogs playing a very different game, and believe they're playing the same game. So you get SaaS companies that can be great business and even good venture-backed businesses. But they, instead, focus on raising billions at 100x ARR, chasing multi-billion dollar outcomes, only to find that those outcomes are out of reach, and their funding approach has made it unlikely that most people will benefit from what they've built.

Where Do We Go From Here?

I feel literally breathless writing this. Probably one of the side-effects of having no consistent writing habits, and just waking up at 4 AM on Saturdays to try and panic write the things I've been thinking about. My friend Hunter Walk tells me I ramble too much, and I'm afraid this piece isn't going to do anything to disabuse him of that notion.

But as I sit back and reflect on all these things that are spinning around in my mind, I kept coming back to this idea of "normal." Then, coincidentally, I saw this tweet from Sam Altman yesterday:

And I think it comes down to norms. The process of building a company is a micro activity that is informed by a macro picture. But being informed and being shaped are not the same things. Unfortunately, a lot of people let the macro dictate their path, like a pseudo-capitalistic "Jesus take the wheel" attitude.

But as AI reshapes the world, and what it means to build and create, its more important than ever to develop a sense of self-reflection. Why do you believe what you believe, why do you do what you do? Why are you building a company? Why are you investing in this company? The same way that I strive to be religious, but open-minded, everyone who buys into the religion of AI and technological progress should attempt the same open-mindedness.

Question things optimistically. I know there is huge value and opportunity in AI. But there are also so many opportunities to do harm. And I don’t just mean AI safety. Businesses need to be more aware than ever that there is not just one reality. Companies exist in a nuanced multi-faceted realities that can’t be defined just by the largest and loudest companies and investors.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

i dont think you ramble too much. Just that last post put together a lot of different things that, in my opinion, each could have stood on their own!

I think AI will significantly change our life, maybe. We are still in the beginning stages. What really annoys me is that every time I go on the internet there is someone trying to convince me that I can build a 7 figure business with ChatGPT. It's cool that we can generate images, it can be really fun. Will it replace humans? Nope.