This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Biographies can be incredibly humanizing. You take these people that feel larger than life, and hear about their mistakes and embarrassments. One story that I enjoyed comes from the book "What It Takes," by Stephen Schwarzman, the founder of Blackstone.

As a junior banker, he'd built a financial model (pre-Excel, just cranking out paper calculations), and as he and his boss were flying to present it to their client his boss realized he'd made an error in his calculations. He handed it back to Schwarzman and said, "just pull out the bad pages, and it can still work."

When they arrived at the client's offices, his boss began the presentation:

"'As you can see from the analysis . . . I think we have a statistical error.' As he spoke, he all but launched himself across the table grabbing our presentation books from the board members. “I can talk you through this without any numbers.” I had been so freaked out by my mistake that instead of tearing out the bad pages, I had torn out the good ones. I could have melted under the table. We left the company, got in the cab, and rode back to the airport. Not a word. Right before they called the plane, Eric turned to me: ‘If you ever do that to me again, I’m firing you on the spot.’”

Stephen Schwarzman has a net worth today of $26 billion, and even he made stupid mistakes like that. You start to see this human side of people who have built massive institutions in a way that makes them feel a little more comprehendible. But then you remember that Blackstone is an $800B+ behemoth. They gave rise to BlackRock, which is now managing $10 trillion of assets. Less and less comprehensible. Another quote from Schwarzman's book frames this massive aggregation of assets:

"[One] way we thought about building our business was to keep challenging ourselves with an open-ended question: Why not? If we came across the right person to scale a business in a great investment class, why not? If we could apply our strengths, our network, and our resources to make that business a success, why not? Other firms, we felt, defined themselves too narrowly, limiting their ability to innovate. They were advisory firms, or investment firms, or credit firms, or real estate firms. Yet they were all pursuing financial opportunity."

Another way to put it? If you ask someone in one of these investment firms that seem to be exploding in AUM, "are you in the private equity business? The venture capital business? The debt business?" The answer? "Neither."

2% of Anything

I had a friend articulate the asset manager business model perfectly: any asset manager is in the business of multiplying 2% by as large a number as possible. Just about every investment firm follows the same model, whether they're investing in hyper-growth startups, cash-flow generating SMBs, or otherwise. Once you get into public equities, or debt, it gets a little more nuanced, but dedicated funds are all very similar.

I raise $1B from endowments, pension funds, and sovereign wealth funds. I go invest that money into [insert differentiated fund strategy here]. As a fund manager, I earn money in one of two ways: (1) fees, and (2) carried interest (aka carry). Fees can range, but a typical fund collects 2% of the entire fund size every year. In this case, that would be $20M a year ($1B x 2% annually). Carried interest is your share of the upside. So if I deploy my full $1B and generate a 3x return, that's $3B. I give my investors back their $1B, and then for the $2B in returns, I get rewarded with 20% of it for $400M (again, that percentage can vary).

A fund's life can often be 7-10 years, and all along the way you're collecting fees. The big money is in the payout at the end, though that's all dependent on that 3x return. And again, that return might take 7+ years to materialize. By then most firms will likely have raised a new fund, maybe several.

Along the way, what you've gotten is a pretty powerful law of large numbers in asset management. If you raise larger and larger funds, two things happen: (1) the dollar value of the annual fees you're collecting gets much bigger, and (2) your possible return threshold gets lower. It's much harder to 3x a $1B fund than it is to 3x a $100M fund. But if you're managing $20B instead of $1B, you're collecting $400M in fees each year instead of $20M. You start to see the opportunity that exists in raising more and more money.

The Business of Venture Capital

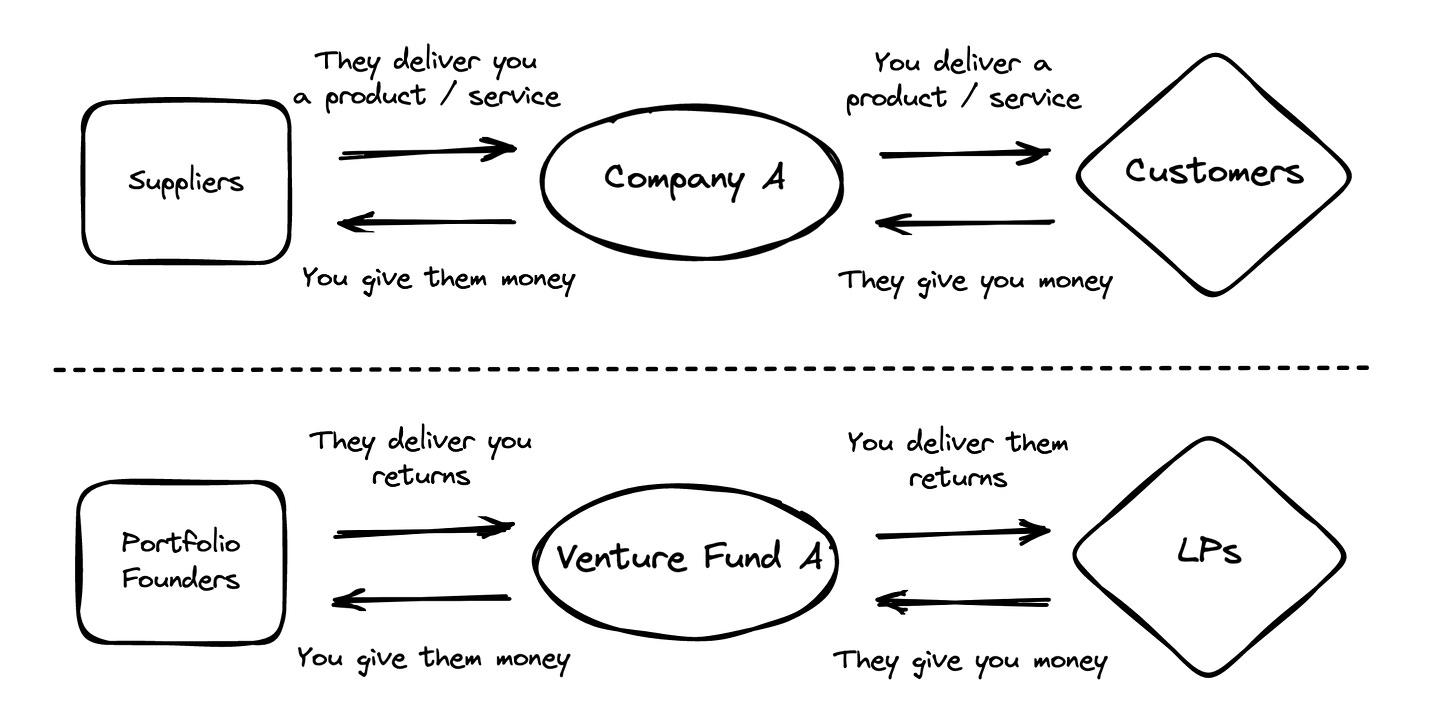

In venture capital, the ethos is so often clearly articulated as "we are helping you build your business right alongside you." And while there are a number of exceptional VCs who are founder-focused, its important to remember the business model of venture capital.

At its core, venture is an asset management industry. Some firms, like Homebrew, take a unique approach by investing out of an ever green fund made of their own money. But that's a rare exception. The vast majority of the venture capital world operates under a typical fund structure: raise capital from LPs, take a management fee, invest over the course of 5-10 years, collect carry on the performance of those investments.

Business building is the marketing, but asset management is the business model.

I don't mean to imply that no VC is founder-focused, many are. Many are building unique models to best serve the needs of founders who are inventing the future. But I think it's important to reflect on the reality that, despite the marketing, founders are not a VC's customer. LPs are. The real customers are where the revenue comes from, and both (1) fees, and (2) carry come to VCs through LPs.

Some people will point out, "well, but the carry is earned off the return that the founders create. So half of the business model revolves around founders." And that's true. But VCs only have access to the carry because the LPs agreed to give it to them.

Take this as an example. Accel invested $12.7M in Facebook in 2005, and that generated a 700x return. But of that $8.8B return, Accel got 20%. They didn't get it from Zuckerberg. They got it as their contractual reward from LPs. "For investing my money, I'll give you 2% every year, and 20% of the money you make me after I get my money back." So every "revenue stream" for a VC is coming from LPs. Not from founders.

And as a founder you need to be aware of this, and thoughtful of it. Because, just like Facebook, if you're not the customer? You're the product.

This disconnect is one of the reasons I think there is such a spread right now between founder expectations, and VC's reality. A VC is doing the math around the returns they can offer their LPs, and as expectations for those returns have plummeted alongside public markets, the "founder friendliness" in terms of price, flexibility, and overall "wooing" has gone down. Because VCs have to take into account their customer's expectations (e.g. their LPs), even if it’s at the expense of their founders.

And this reality can be true to varying degrees depending on the firm. But if you're a large firm with massive assets under management, your business model is increasingly focused on collecting the big pile of fees on that AUM. And when that's the case you grow your AUM in an attempt to offer more "products" to more "customers." Take a16z as an example. They raised "a $4.5 billion crypto fund, a $5 billion growth fund, a $2.5 billion venture fund, and a $1.5 billion bio fund—all just last year." Those are all different "products" that LPs can get excited about having exposure to. AUM aggregation is increasingly becoming the name of the game in startup / VC land.

The Innovation Markets

You have the whales raising massive funds: a16z ($5B), Insight ($20B), Tiger ($12B). But raising billion dollar funds isn't just the strategy of the few largest firms. It's becoming quite common. As of June 2022, there were nearly 30 different firms that had raised $1B+ funds. The craziness of how many firms are raising $1B+ funds reminds me of when a "unicorn" valuation became the average for some venture rounds in 2021.

So why is this happening? We can turn again to a quote from Schwarzman about his philosophy in building Blackstone for some perspective:

"It’s as hard to start and run a small business as it is to start a big one. You will suffer the same toll financially and psychologically as you bludgeon it into existence. It’s hard to raise the money and to find the right people. So if you’re going to dedicate your life to a business, which is the only way it will ever work, you should choose one with the potential to be huge.

A lot of firms recognize that, once they get their flywheel spinning of LPs, performance, brand, and expertise, why not scale it up? Why not increase their ability to do a wide variety of things? Not only does it give the firm more optionality, but it doesn't hurt that the expansion just keeps bringing in more and more fees.

But how do LPs feel about it? For some, it's a welcome option.

Buying IBM For LPs

Many LPs are often managing huge pools of capital, so they sometimes prefer the largest funds because it doesn't move the needle for them to invest $25M in a $500M fund. They want to invest $250M+ in a multi-billion dollar fund.

Especially in times of economic uncertainty, LPs are trying to make safe decisions. Even when they're facing some headwinds with their existing fund managers that might give them pause, there's a big difference between having some concerns, and “[being] willing to confront [top managers] about their concerns—or walk away from investing in the firm’s future funds entirely."

Instead, the current downturn will likely exacerbate the aggregation of assets to a few top firms, rather than disperse it. Some people will point to LP's interest in emerging managers, and there is certainly a market for fresh, new fund managers taking novel approaches to backing startups. But there isn't a lot of wiggle room for experimentation.

Those $1B+ funds are already becoming more and more of the concentrated capital in venture. 60% of all the capital raised in 2022 went to $1B+ funds; that's up from 34% in 2021. The top 20 firms are managing 10% of all venture capital.

Francesco Perticarari, a VC in London, summarized this concentration super well in a recent article:

"All of this means that we are now in a time when, for large VC funds, a startup achieving a $1bn+ outcome is meaningless. To hit a 3 to 5x return, megafunds need startups that can (1) take on hundreds of millions or even billions in investment, and (2) exit at north of $50bn dollars.

If you look at all public tech companies today, fewer than 50 have achieved that valuation.

This mentality and the concentration of capital into only a handful of funds is creating an ever-growing funding gap between the founders whom these funds back and everyone else. What’s more, larger funds are creating a close network of hype in their quest to engineer the next $50bn+ Uber, which means they naturally end up investing in a lot of the same companies."

So let's dig more into what can happen with this kind of concentration.

Keeping An Eye On It

"An Index Fund of Private Markets"

A standard cadence of investing volume for a large firm is something like Sequoia making 37 core investments in 2020, and ramping that to 43 in 2021 (not including ~70 early stage stealth companies over the last three years). But what about some of the more... hyper active folks?

Tiger made 361(!) investments in 2021. Even in 2022, while their hedge fund is down 50%, they still made 280+ investments. a16z went from 104 investments in 2020 to 241 in 2021. Talk about aggressive.

Some people refer to these massive portfolios as an "index strategy" where you have collective exposure to a huge swath of the private tech markets. I keep thinking about that, and it's never exactly sat right with me. Let me explain why.

Now, granted, there is a whole discussion to be had about the pros and cons of index funds, and the impact they have on the market. But one point I'd make is that the largest index fund is the Vanguard Total Stock Market Index Fund, which is $1.3 trillion, representing ~2% of the U.S. equity market. Vanguard as a whole has $8 trillion of AUM, which is ~17% of U.S. equities. Given the disparate strategies, and allocations, I wouldn’t say that index funds move the entire market for better or worse.

Among later stage startups, the largest venture funds can make up a majority of those rounds as they write larger checks. What's even more impactful is that they move the market in a way that doesn’t happen in public markets. So when Tiger and a16z get aggressive in pricing rounds, it trickles down to the rest of the market as a comp. That trickle down affect impacts the rest of the market as worse companies look for comparable valuations.

That concentration is a big part of what drove valuations higher and higher in 2021, and set a lot of companies up for failure by having their valuations set to unrealistic marks because of the movements of the biggest players in the market.

Optionality For Founders

There's also something to be said about how, as larger funds get larger it sucks the oxygen out of the LP market for other funds, making it harder for smaller funds to exist. Not only do smaller funds often generate higher returns than larger funds, but founders' optionality is more limited if they just have the Unilever or General Mills of venture to choose from.

I've written before about the strength of individual investor brands. And I feel strongly that, the more each investor is responsible for more clearly articulating their own value proposition and "vibes," the better off founders will be in finding the right partner.

Illiquidity Lock In

Finishing where we started, recently we've seen an example of how a behemoth like Blackstone can get a little too creative in its asset aggregation, and cause some heartache.

In a move to access more retail investors, Blackstone launched Blackstone Real Estate Investment Trust (Breit) to offer commercial real estate exposure to individual investors, explicitly citing to Blackstone’s own shareholders the "potentially transformative effect this could have on its assets under management." In the pursuit of surpassing $1 trillion in AUM, they introduced a specific investor base to a "less-than-liquid" asset class. When markets became more tumultuous, their investors suddenly realized the weight of their illiquidity.

As larger venture firms look to build their AUM, its completely reasonable to expect to see them launch distressed debt funds for struggling startups, venture debt facilities, maybe even real estate funds to give their startups office space. In the pursuit of AUM, you may see exposure that not everyone is ready for.

What Does This Mean For Venture Capital?

Founders will continue to get bundled as larger firms start thinking about their portfolios as “asset exposure,” rather than individual company journeys. Ask a founder, who raised at a hefty valuation, what their VCs are doing for them right now. The good ones are helping figure out the process of battening down the hatches, and growing their business more thoughtfully. But a lot of them? Disappearing. The "asset" is underwater, and they're better off spending their time with assets whose price isn't as miscalculated.

As the aggregation of assets in venture continues, there will be pros and cons. Some of the value-add of different venture firms is made possible because they become a center of gravity, and that's powerful. But for founders, it’s important to understand the business model of these larger firms and how much or how little your company's outcome may move the needle for them, and therefore how motivated they are for you.

At Contrary, I think we've found a way to avoid some of the misaligned incentives that exist, even as we also grow our AUM. Contrary's focus is on people, first and foremost. We have a community of several hundred talented builders and future founders that we support, and every aspect of our "product engine," we build with them in mind. As a result, everything we do is meant to benefit, as much as possible, the builders in our ecosystem, even if we're not investors (yet).

We launched Contrary Research to the public, rather than keeping it for our companies / founders because (1) our research will get better as we expose it to the outside world to tell us what we're wrong about, and (2) we can share (what is hopefully) a balanced perspective. If we use our research to pump just our own portfolio companies, then some of the folks in our community might suffer from a limited perspective, and that breaks our flywheel.

As you evaluate every different venture fund, and the strategy they employ, be sure to consider their business model. Consider their incentives. And try to clearly understand whether you are a partner with them or a notch in their AUM collection.

** Thanks to Gaby Goldberg for originally riffing with me on the idea of "The Blackstone of Innovation." You can also hear me talk more about it on 20VC with Harry Stebbings.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

such a great discussion, and i don't say this just because you mention us :)

One of the best reads of 2022.

...Particularly on the point about companies with (what would have been) large exits not moving the needle.

I do think this creates a powerful counter-positioning mechanism for smaller funds, but then they also need data (qual and quant) that quickly validates that such attention is productive.

I’m talking with some LPs / friends who run family offices etc., some of them scoff at the notion of a firm “being in the trenches” with founders -- “let entrepreneurs run their business.”

I think this refrain works for some founders, but the reality is that most pre-seed or seed founders are doing this for the first time, and need thoughtful, deep help, and that can go beyond getting research reports and ascend towards someone actually sitting down with you for 2-3 hours and being an actual team member. More LPs should consider the styles of involvement honestly, and maybe consider this as a dimension for investment -- degree of involvement / VC-portco collaboration model

Anyways, awesome writing as always, Kyle. Reach out if you’re ever in ATL -- would be awesome to grab coffee