This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

This is a brief post sharing more about an upcoming Contrary Research event I'm helping host.

The world has become increasingly noisy. More products, more sales pitches, and more demands on time, attention, and budget. It's increasingly difficult to set your product apart. So, I wanted to talk about one key thing that lets companies like Vercel, Sourcegraph, and Hashicorp stand out: customer acquisition.

I must really like the post from Evan Armstrong called "When Content Goes To Zero" because I referenced it last week, and I'm going to reference it again now:

"[Evan] explains the core components of a business: (1) Create stuff, (2) Acquire customer to buy stuff, and (3) Distribute that stuff. He describes the impact that AI will have this way:

'The internet broke the third category of distribution, and AI is going to break the first one. Innovations like GPT-3, DALL-E, and other AI tools will dramatically decrease the cost of producing goods with a digital component.'

So what does that leave? Customer acquisition.

Finding unique ways to acquire customers who love your products is critical for standing out. It was also a big focus of my post last week. The core idea for every company is to find unique ways of "building customer love."

However, the way people have gone about doing that has really evolved over the last few years. The first iteration was product-led growth (PLG) where companies let their products do the talking for them. After first being coined (I think) by Openview Venture Partners, interest in PLG has steadily grown.

But today, the majority of incumbent products are also using product-led growth. Companies like Zoom exploded via product-led growth, beating out products like Citrix and GoToMeeting. But today, Zoom is the incumbent, and PLG is a part of their DNA. Across the board, PLG is now table stakes.

For Contrary Research, we recently published a memo on Common Room where we dug into the growing market for community-focused go-to-market motions:

"Insight Partners surveyed its portfolio of over 400 software companies in May 2022. It found that 25% of their companies had adopted community-led growth motions at the time of the survey, and 55% were planning to test in 2023. The same survey indicated that 73% of Insight’s portfolio companies had established community budgets for people, tools, and programs, with companies spending an average of 9% of their marketing budget on community."

You can check out Insight's whole presentation here:

The combination of PLG, user communities, and open-source software has focused every high-growth company on understanding their user bases much more intimately. Take HashiCorp as an example. The company has built a broad product portfolio, many of which have come through deep engagement with the company's community.

That community-driven approach and deep understanding of users helped produce HashiCorp's most popular product: Terraform. In its lifetime, Terraform has been downloaded 100M+ times across 1.2K enterprise customers.

At Contrary Research, we've highlighted other companies that have leaned into the power of customer love.

Sourcegraph has 1.8M+ users across companies like Uber, Canva, Plaid, and Databricks.

Vercel has 4M+ installs of Next.js, and powers 35K+ sites for companies like Uber, Nike, and Starbucks.

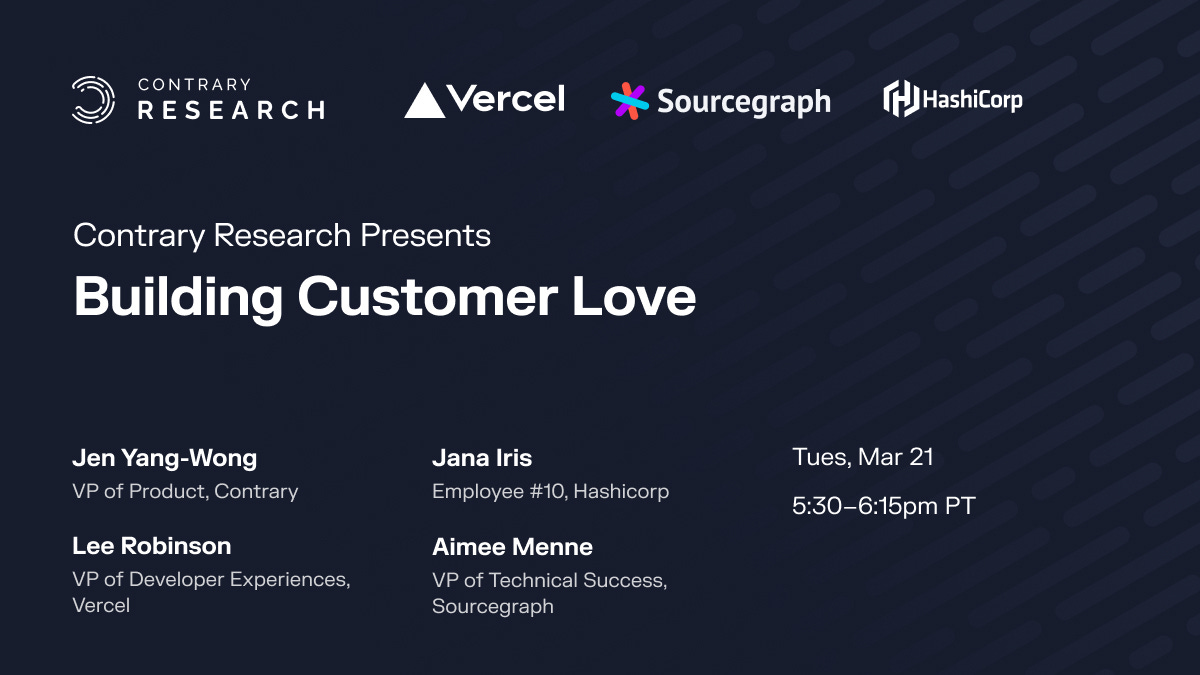

This idea of building customer love fascinates me. That's why, as part of Contrary Research, I'm helping put on an online event called "Building Customer Love" on March 21st.

If you want to learn the power of building customer love, come learn from some of the greats. The event will be hosted by our VP of Product at Contrary, Jen Yang-Wong.

In addition, we'll have participants like Lee Robinson, VP of Developer Experiences from Vercel, Aimee Menne, VP of Technical Success from Sourcegraph, and Jana Iris, who is an investor at TQ Ventures, and was previously the 10th employee at HashiCorp (now 2.5K+ employees), and who helped build a lot of their early community efforts.

Would love to see you there!

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week: