This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

I've written over and over and over and over and over and over and over and over and over again about storytelling.

I've also written over and over and over and over and over again about hype.

Two sides of the same narrative coin: the breadth of the story and the breadth of how believed it is.

Unbelievable progress is made through the consistent back and forth of two steps: big promises and big payoffs.

I'm pretty sure I've written about this exact idea before but after 130+ posts over the course of 2.5 years (not to mention the pretty atrocious search on Substack) I'm increasingly finding myself incapable of finding my own ideas. 🤷

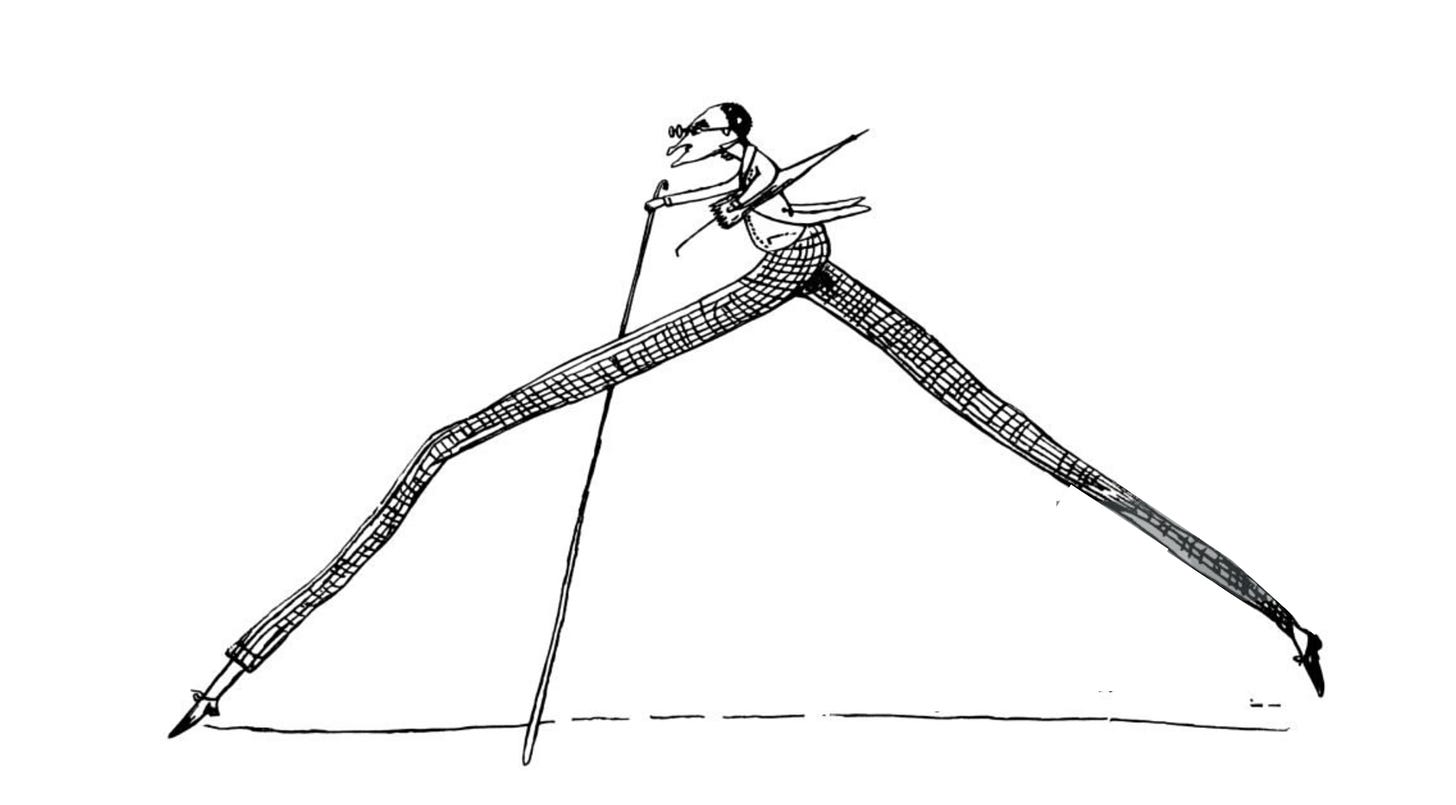

I even managed to find the image I used last time (guy with the long legs). So if anyone remembers seeing this picture in one of my previous Substack posts, let me know.

Imagine yourself taking massive steps. You make a big promise. That's one step. You manage to pull off a big payoff. That's another step. Promise and payoff. Promise and payoff. But too often, people become obsessed with just one step: the promise. They end up spreading themselves wider and wider, all on one leg.

Big Promises

Oftentimes, the promise can be the most powerful thing. It can be the thing that pushes dreams, even seemingly impossible dreams, into reality. The best description I've heard of this power is what some have called the "reality distortion field." I wrote about it this way in The Meme Economy:

“In Chapter Three of Steve Jobs, biographer Walter Isaacson states that around 1972, while Jobs was attending Reed College, Robert Friedland "taught Steve the reality distortion field." The [reality distortion field] was said by Andy Hertzfeld to be Steve Jobs' ability to convince himself, and others around him, to believe almost anything with a mix of charm, charisma, bravado, hyperbole, marketing, appeasement and persistence. It was said to distort his co-workers' sense of proportion and scales of difficulties and to make them believe that whatever impossible task he had at hand was possible."

Isaacson elaborated this way:

"The reality distortion field was a confounding mélange of a charismatic rhetorical style, indomitable will, and eagerness to bend any fact to fit the purpose at hand."

The very best entrepreneurs, from Thomas Edison to Walt Disney, Bill Gates, Elon Musk—they all built their empires around big promises.

And big promises are critical. If you never make big promises, very few people will care about what you're doing. In some instances, that might be fine. But if you're dependent on talent, capital, partners, or anyone else who needs to believe in something to commit to it, then at one point or another you have to start telling a story. A story worth believing in.

There have been companies, like Calendly, Mailchimp, or Qualtrics, that I would argue didn't need this to the same extent. I've rarely seen anyone cite any of these companies as representing talent vortexes that have gone on to staff dozens of other companies with exceptional talent, or visionary products that transformed a category. But they managed to deliver exceptional payoffs, despite never telling the most grand ambitious stories.

But the other side of the coin? Big payoffs? Without those, you die.

Big Payoffs

You might think Tesla is a house of cards. But they deliver. You might even hate what they deliver. But they keep shipping. Big promises? Sure. They even have proxies painting bigger and bigger promises. But they do have payoffs.

You might hate Anduril, and think its just VC hubris chasing big markets, with no viable path to success. General Atomics, one of the major defense primes, recently referred to Anduril as “the Theranos of defense."

But Anduril has payoffs. Example? Getting awarded a $1 billion contract with SOCOM. "But its fluffy money." "They didn't earn it." Not only did they earn it, they blew the competition out of the water in the process:

"There was a full competition for who they were going to select for this. They did a shoot off between all these different companies. And some of the companies that [Anduril] beat were actually getting paid by the government to develop their systems using government money."

The government was literally PAYING Anduril's competitors to beat them and ANDURIL STILL WON. That's what I call a payoff.

Promises Without Payoffs

I can't think of a single instance of an outright fraud going the distance. Maybe there are plenty of conspiracy theorists that will argue about that, and I'm curious to hear what people think. "Well Kyle, what about the perpetual fraud that is the federal government?" Mm... sure.

But in general, they don't stand the test of time. There are two famous Buffettisms that touch this. First?

“In the short run, the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long run, the market is a weighing machine.”

Like in A Knight's Tale, sooner or later you will be weighed, you will be measured, and you will be found wanting.

Second?

"Only when the tide goes out do you discover who's been swimming naked."

Theranos, Enron, WorldCom, Fyre Festival, FTX... even WeWork, though you might argue it's not an outright "fraud' like the others, it was absolutely a heap of promises with very limited payoffs. In fact, the payoffs were so de minimis and distant that nothing undid the company other than just... filing for an IPO!

And that's a key takeaway about the balance between promises and payoffs. Even the greatest storyteller in the world will eventually be called upon to deliver payoffs. Otherwise, that's when you slide down the slippery slope to charlatan, cuckoo, or just plain wrong.

Big Promises With Big Payoffs

The very best entrepreneurs are not just storytellers. And the very best business builders are not just chasing payoffs. The people who build the most exceptional businesses are those that understand the artistically nuanced balance between big promises and big payoffs. Do they deliver every time? No. But they deliver enough to maintain that balance; that equilibrium between fantasy and reality.

The best stories are those that compel you to believe in them, but its the payoff that rewards the faith people put in storytellers. Its when I'm promised a product or feeling or experience that compels me. And then I get it!

Bezos' customer obsession principle isn't "pay super close attention to what the customer wants so we can tell them a nicer and nicer story." You're obsessed with the customer because you want to understand the payoff they're hoping for and then tell them a story that will compel them to believe you long enough for you to deliver.

Investors spend a lot of time wondering about the question, "what do you have to believe?" But as you spend more time with a company or a founder, you also need to start asking yourself, "why should I believe this?" One of the most common phrases at Contrary Research that we use to push back on each other is “prove it.” What evidence do we have that supports believing that thing? What small steps of payoff have I seen that merits me taking yet another step on the credit of promise?

Jesus said, "ye shall know them by their fruits." It's not enough to just like the story. You have to look at the fruits of the storytellers. What have they wrought? Has it paid off? And if not, is it worth believing in their promises?

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week: