This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Almost exactly a year ago, I wrote a piece called "The Age of Acquisition."

In that piece, I talked about how much I loved playing the video game Age of Empires II. I used the game as a backdrop to introduce the piece:

"In that game, the outcome was almost always zero sum. One person won and everyone else lost. In the actual history of conquest, that's rarely the case. Almost every empire that's been built has done so with allies. Collaborators in attempting to control more of the known world. Building businesses isn’t so different. Sometimes for a company to go the distance, they have to embrace "Simul Fortior." Stronger together. Occasionally, that collaboration comes willingly. Other times? A combination of competitive forces and macro conditions force collaboration, whether you like it or not. The alternatives become collaborate, consolidate, or die."

I went on to unpack the macroeconomic correction, how capital suddenly pulled away from a generation of businesses that were built on an unstable foundation of paid marketing, expensive GTMs, and just in general paying to sell something that people don't yet want to buy (e.g. lack of product-market fit).

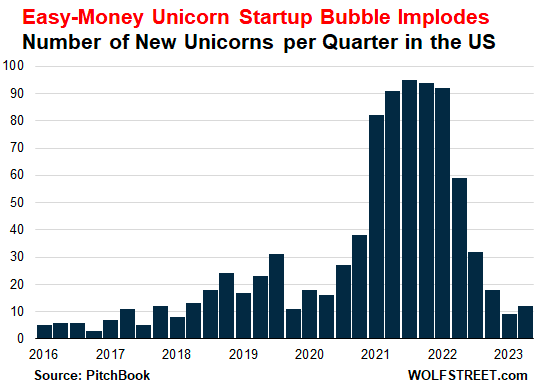

Those unsustainable business models attracted unsustainable amounts of capital. And when that capital rug got ripped out from under everyone, the model for minting unicorns fell through the floor.

As the capital shuts off, companies have to start unpacking what their future looks like. For some companies, they raised hundreds of millions without dramatically ramping burn, so I've seen several companies that have 6+ years of runway to figure things out.

For those who are closer to running out of cash, they've had to consider down rounds, wind downs, and layoffs. But for others, M&A has become the path forward. In the original piece, I unpacked four different types of M&A I expected to see in 2023: (1) Big + Big, (2) Big + Small, (3) Small + Small, and (4) PE acquisitions. Then I wrapped up with some predictions. So let's revisit.

Big + Big

A lot of the largest acquisitions of two big players coming together often happen more in media and telecom rather than tech. That being said, there were still some pretty interesting mega deals this year:

In my perspective, there are two main reasons that large companies acquire other large companies. On the one hand, that's often a lack of innovation. It's older, less creative companies acquiring their way to some semblance of relevance.

That reminds me of Okta's acquisition of Auth0 in 2022. A lot of people believe Okta has completely saturated their existing market, and that Auth0, as a play in CIAM, will make up 50%+ of Okta's revenue over the next few years.

On the other hand, another reason big companies acquire other big companies is domination. Microsoft has made some incredible acquisitions (GitHub, Linkedin, etc.) and Activision will further solidify their dominance in gaming.

As interesting as some of these big deals are to unpack (e.g. what is Cisco gonna do with Splunk?), it's not where most of the most compelling speculation is. Instead of focusing on Big + Big, I made this point in the original piece:

"In tech, most of the best acquisitions come from larger players buying an innovative smaller player to bolster a different aspect of the parent company's business."

Big + Small

In the original piece, I pointed to Microsoft + Activision or Adobe + Figma as examples of Big + Small, but often once you cross into the $10B+ acquisition price, it really is a big acquisition. The Big + Small is often more a function of identifying under-appreciated pools of value. Facebook + Instagram at $1B, for example, established Mark Zuckerberg as one of the best capital allocators in history.

So when I thought about watching for Big + Small acquisitions over the course of 2023, I had this to say:

"This is certainly one area of M&A that I'm excited to watch. There are a number of companies that are bolstering their product platforms, and expanding their addressable market that would love to snap up some innovative additions."

And the year did NOT disappoint. This was by far the most active category:

In general, these kinds of acquisitions can sometimes be the outcome of last resort. Things aren't working, and if you can find a soft landing, that's great.

Other times, its not the outcome you would have hoped for but its not a bad outcome.

And finally, they can often be great outcomes that represent a huge boost in value both for the acquirer and acquiree. Those are the outcomes you hope for.

For the ocean of so-called "unicorns" out there, this is a likely end for what they've built. And if its unlikely you can exist as a standalone company for the long-term, its either this, or outcomes like IRL, Olive AI, or other shutdowns (more on that later).

I do want to point out, though, that in particular categories these types of acquisitions can be incredibly powerful. Data infrastructure and cybersecurity, for example, are complex categories of interwoven technology. Simul fortior can be a powerful strategy.

Take Snyk's acquisition of Deepcode in 2020, for example. Snyk was already a powerful tool to help with shift-left as more developers tackle security. But in 2020, not as many people were thinking about applying AI to code gen and analytics. Deepcode set Snyk up to be one of the first to be really evaluating code vulnerabilities with AI.

SentinelOne + Wiz

One rumored deal that didn't happen was SentinelOne + Wiz. And it's also hard to categorize. Today, SentinelOne's market cap is ~$5B. Wiz's last valuation was $10B earlier this year. So in a surprising twist, it would have been the larger (potentially overvalued) private company acquiring the smaller (potentially undervalued) public one.

In March 2023, the two companies announced an exclusive partnership. In the announcement they explained the synergies this way:

"Through the strategic partnership, the combined expertise of Wiz’s Cloud Native Application Protection Platform (CNAPP) and SentinelOne’s Cloud Workload Protection Platform (CWPP), can be offered to organizations of all sizes and equip customers with a best-of-breed cloud security solution that provides superior capabilities to detect, prevent, investigate, and respond to cloud security threats, allowing them to dramatically reduce their risk."

The acquisition rumors started swirling in late August 2023. On August 25th, Wiz hinted that it was considering acquiring SentinelOne. One driver in the potential sale was SentinelOne's continued struggle to become profitable. Five days later, on August 30th, SentinelOne unceremoniously cancelled its exclusive partnership with Wiz, citing a "continued lack of execution against their agreements."

Finally, on September 1st, SentinelOne CEO Tomer Weingarten denied any possibility of an acquisition, claiming it was an "unbelievable amount of rumors and speculation."

So, who knows? But one company's lack of profitability, and another's war chest of nearly $1B in funding can easily lead creative thinkers to get carried away dreaming of the possibilities in the age of acquisition.

Small + Small

Finally, among the company to company transactions you have the small + small (sometimes the VERY small to VERY small). And there was plenty of activity there too this year:

Bird acquiring Spin for $19M (This one is rough. From a ~$2B IPO market cap, the company was already only at a ~$20M market cap at the acquisition. Today? The company's market cap is $6.5M).

Smaller acquisitions are often those where the companies made more sense alongside another platform vs. as a standalone company. They're not massive outcomes, and so they typically reflect the value of the team or an individual product. But, unlike in a Big + Small acquisition, they may sometimes also represent dramatically more value to the acquirer.

For larger companies, like Discord acquiring Gas and then shutting it down 7 months later, that's not a huge hit to Discord's overall business (other than the egg on their face for making the acquisition in the first place).

For a company like ActiveFence, on the other hand, they've only raised ~$100M in total funding. So to acquire Spectrum Labs for $137M, that means they likely used some leverage, maybe raised some more capital and put it towards the acquisition. If that company is writing down Spectrum Labs to a zero in 7 months? That's a kiss of death.

PE Acquisitions

Finally, there are a number of PE firms that got hungry this year:

On the one hand, this makes perfect sense. Companies have been pretty heavily over-valued for the last few years pre-2022, and if there's one thing PE firms don't want to do, it's over-pay. So now is their time to shine. On the other hand, for many of these firms they're doing leveraged buyouts, which typically rely on cheap debt. Higher rates means a lower availability of affordable debt for these types of deals. That's had an impact across PE.

What's more, software companies are NOT notoriously profitable. LBOs typically rely on the ability to harvest cash flows to pay off debt and juice returns. Without much cash flow (and with an increasingly difficult macro environment to perform in) you may see a fair bit of strains on these companies.

For example, Qualtrics was one of the largest take-private deals of the year at $12.4B. In 2022, the company generated ~$1.5B in revenue on a net loss of ~($1B). The terms of the deal were majority equity investments from Silver Lake and it's co-investors, but also financed with ~$1B of debt. The company only generated ~$17M of operating cash flow in 2022. So how well they can manage that debt load remains to be seen.

Another example is Coupa. The $8B buyout from Coupa is supported by $2.6B in debt. In 2022, the company has ~$717M in revenue, and ~$70M of operating income. In 2021, the company had ~$168M of operating cash flow. 🤷♂️

As interesting as the PE take privates are, I'm not a huge fan. (1) Because I'm bummed to lose good public comps that I can learn a ton about from their filings, and (2) because it will be a real indictment on unprofitable tech companies if tons of these die under the weight of their debt loads. Time will tell.

Predictions: Past, Present & Future

One concept that was central to my original piece was this concept of "centers of gravity" in a space that had a lot of interest and hype in 2021, attracted a lot of capital, and then has quickly seen that capital and interest suddenly evaporate.

We went from this:

To this:

Very quickly.

I explained it this way:

"When capital is plentiful? They're all competing for the same subset of customers, driving prices down and acquisition costs up. When the cash spigot gets shut off? It exposes a multitude of sins, and they have to start to think about how else to own a category, other than just spending like a drunken sailor."

In my original piece I had a number of categories I thought we could see some action. I wanted to revisit just a few callouts from some of those categories. As I went through them, it was fascinating to see how this concept of "centers of gravity" continued to play a role. One of the biggest drivers of M&A continues to often come down to domination.

Databricks

Obviously the smash hit of the Big + Small category is Databricks $1.3B acquisition of MosaicML. In my piece I pointed to data / machine learning as a category ripe for consolidation. While MosaicML was the main M&A play in the space, you saw a number of big rounds, like Hugging Face raising $235M at $4.5B or Weights & Biases raising at $1B+. That category is just getting started.

Right now, Databricks and Snowflake are the prime centers of gravity in the space. This past week's OpenAI implosion and reassembly is only going to push more people towards open source models. I'm excited to watch this space consolidate even more in 2024.

API Security

One category that I thought was ripe for consolidation was the API value chain. From testing (Postman) to API gateways (Kong) to API security (Salt, Noname), there's such a clear development lifecycle there. Why wouldn't people start to consolidate? I would have expected small + small deals (e.g. Salt + Noname). But instead we got a Big + Small acquisition that came with a dash of drama.

In December 2021, Noname Security raised a $135M Series C at a $1B valuation. Meanwhile, Neosec, a newer API security company, had raised a total of ~$20M in funding.

In February 2023, rumors started to fly that Noname was "in negotiations to be acquired for hundreds of millions of dollars." So not a billion, but not nothing. Akamai ($17B market cap) was listed as one of the companies supposedly interested in the deal, but Noname didn't comment. For a few months, nothing else came of it.

Then, in April 2023, Akamai announced they had acquired Neosec. Akamai is a content delivery network (CDN) and cloud platform, so helping to manage APIs is a logical extension of their ability to manage, monitor, and secure web traffic.

First, full disclosure. I don't know anything behind the scenes about any of these companies. I met both of them years ago, but I never invested in either of them. So this is pure speculation. But what seems so interesting about this is that Akamai likely looked at Noname, Neosec, and others. They wanted to make an API security bet, but when push came to shove it made so much more sense to acquire a company that didn't have a $1B valuation hanging over its head.

I've summarized my thoughts on this type of dependence before:

"I wrote a piece over a year ago called "What's In a Valuation?" where I tried to unpack the "valuation stick" that founders pick up when they decide to raise at a massive valuation. When you pick up one end of the valuation stick, you end up picking up the other end that is fraught with significant expectations of outcome."

Banking-as-a-Service

Another category that I pointed to as ripe for consolidation was Banking-as-a-Service. We've got an awesome deep dive coming out soon for Contrary Research where we unpack the whole category, so if you haven't already, be sure to subscribe.

This was another one where I thought we would see more small + small consolidation of equals (Unit, Bond, Syncterra, Treasury Prime). Instead we saw a Big + Small deal where FIS ($32B market cap) acquired Bond, a company with 30 employees. The Techcrunch coverage of the acquisition described it this way:

"It’s not clear why Bond has opted to get acquired, but the deal comes amid a very unsettled period in the worlds of technology, venture funding and financial services. Funding activity has largely ground to a halt in the world of startups compared to previous years, which partly contributed to the collapse of two major banks focusing on the tech sector."

Bond hadn't raised a round since 2020, and likely saw M&A as the path to remaining relevant, as opposed to falling victim to NOT being a center of gravity in what has become a pretty competitive space with larger, more well-funded players like Unit and Treasury Prime.

What Does This Mean For Venture?

Finally, I touched on the impact of M&A on venture funds. Not just their companies getting acquired, but the potential for consolidation among venture firms. I'd touched on this idea before this way:

"Over the last few years the number of venture firms has grown from ~900 to nearly 2,000 different firms managing $500B+ of capital. In a market correction some people predict as many as 50% of those firms could fail. One prediction I have is that as venture funds have become more productized they've developed more IP and proprietary processes. As a result, even though you'll still see some firms shut down I also believe you'll see some venture firms get acquired. Not only for their portfolios or people, but for the things they've built."

Venture funds are incorrigible creatures, and can take decades to die. So its unsurprising that consolidation would take much longer if it is going to happen. But interestingly enough, we saw a few consolidations in 2023.

Jeannette zu Fürstenberg started Germany-based La Famiglia VC in 2016, and in 2023 raised their third fund, a €255m seed fund, and a new €90m growth fund. The firm had no paltry track record, having invested in Personio, Stripe, Deel, and Ramp. But in October 2023 they announced they were merging with General Catalyst.

In the announcement, Fürstenberg described the drivers behind the merger this way:

“We’ve probably reached the end of the SaaS curve. There’s probably going to be a redistribution of market share. If we think about what this next wave of innovation is going to be, it’s probably going to be anchored more in a shift from bits to atoms."

General Catalyst is managing $15B+ of AUM. Calling this a merger is generous. This is General Catalyst acquiring a well-established European brand at seed to push deeper into the geo. Other firms, like a16z, ICONIQ, Insight, and IVP have branched out of the US by opening offices in London, etc. GC just happened to leverage M&A to do it more quickly.

You're also seeing other, more out-there acquisitions, like French venture fund Founders Future acquiring an equity crowdfunding platform. In the announcement the firm says there will be "no synergies between the two operations," so I'm more confused by this one.

But by and large, you're seeing venture funds get more creative in how they think about building out their platforms. And consolidation can play a major role in that effort.

Adapt Or Die

My partner, Eric Tarczynski, published a great breakdown of what's happening in the startup world. How we saw a big spike of panic in early 2022, belt-tightening, quick blowups like Fast, and then things got sort of quiet for a while. But the reality is, there is still a host of companies out there that are just not working and are fueled by excess ZIRP-y cash to stay alive longer than usual. But we're starting to see more cracks.

Babylon Health went from $2B to bankruptcy. Consumer payments startup Braid, who raised $10M from great firms like Index and Accel, shut down. IRL shut down and its founders are now in a lawsuit against its investors over whether 95% of its users were bots. Zeus Living, armed with $120M+ from backers like Airbnb, shut down. Catch, even after spending 6 years, $18M in funding, and becoming only one of three companies to get approved to help sell employee benefits, still didn't make it.

Hunter Walk articulated this same reality in a piece at the beginning of 2023 entitled "2022’s Startup Layoffs Will Result In 2023 Startup Wind Downs." He made this point, and it extends beyond 2023:

"I say this all very much being a technology optimist. There are many startups accelerating their growth right now, and founding teams working on ideas that will become the next generation’s defining platforms. But as professional investors we can’t avoid responsibility for managing out the realities of our portfolios. If we avoid these conversations you have no hope of turning a company around, finding them the right home where the work can continue, or assisting executives with the stress and moral choices that come in a struggling business."

I like the phrase "finding the right home." I like it not only in the sense of physical location, or entity ownership, but spiritual finality. Some companies are not meant to survive, and that's okay. Failure, death, defeat—the possible threat of all of those are things that make the lived experience more poignant and meaningful. Consolidation is simply one path towards "finding the right home" for people, ideas, and technology.

But one thing that the consolidation and shutdowns of 2023 reminds me is that we're not out of the woods by any stretch. Each company is bearing the burden of having to prove that it deserves to exist. Because increasingly, we're losing the veils that have hid a multitude of sins. And each of us has to stand and defend the existence of the things we are trying to build.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

ty for the mention!

Great read. I didn't think about the API consolidation, but it's true as you mentioned in the article.

Memo to myself: https://glasp.co/kei/p/e0e247ed74f2125529d6