This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Renegade Spotlights

I worked at large, established venture firms for the better part of a decade. I had the pleasure of working with some exceptional investors along the way. I also had the chance to see some not-so-exceptional investors while I was at it. I joke that I had a Goldilocks experience where I saw TCV (PE-style growth investing), Coatue (hedge fund-style big picture arbitrage), and Index (venture classic). Pretty wide variety! And across that experience I saw lots of flavors of investing, some hot, some cold.

All that time, I had been observant of the changing forces within venture. As I started to think about what I wanted out of a firm, I started to pay attention to the implications of some of those changing forces. In fact, observing that changing dynamic was why I started writing consistently. I spent almost a year looking at how lots of different firms operated, and I wanted to crystallize my thinking.

That thinking manifested itself in two pieces: (1) The Unbundling of Venture Capital, and (2) The Productization of Venture Capital. Since then, I've written dozens of pieces about the changing forces within venture, from The Puritans of Venture Capital to the Institutionalized Belief in the Greater Fool to The Blackstone of Innovation.

Across all that analysis of the venture space, I keep coming back to this idea that, while venture capital as an asset class had been relatively steady for 50+ years, we're on internet time now, and things are starting to shift. There are forces of change at work, and in my writing, I've dubbed the people driving those changing forces as "renegades."

I've laid out some of the characteristics of the renegades of venture capital as I've studied them. These aren't just solo capitalists or startup funds. Any fund or investor who is disrupting the status quo in venture and aligning their offering to optimize for a founder's needs and odds of success can be a renegade. One of my favorite things is to reflect on the impact these people are having. I'm young enough in my career that I welcome radical change. It shakes up the way startups get funded and how companies get built.

In the past I've written about firms that I see as renegades. Firms like Homebrew, Lowercarbon, Paradigm, and The GP. I finally found my own renegade in Contrary, and joined to help them as a changing force in how companies get built and funded.

Since then, I've paid more attention to the shaping forces within how venture works than the individual firms taking advantage of them. So I sort of retired the Renegade Spotlights. But when I see investors executing on new ways of disrupting venture, I still like to think publicly about what this means for the broader venture capital ecosystem. And no firm is a better fit for a renegade spotlight than Renegade Partners. So I wanted to bring the exercise out of retirement to unpack what they're doing.

The Renegade: Renegade Partners

I'm a big fan of students of investing. That's why I enjoy things like Invest Like The Best so much, because you can hear people's excitement over their study of the art of investing.

I named this blog "Investing 101 2.0" much to the chagrin of anyone who likes catchy names; but I did it because I think you can reinvent investing (2.0) as you explore the fundamentals (101). Contrary is a fitting name. But the word renegade means to renounce convention, and that's a pretty good fit too. That is likely one reason why I'm such a fan of Roseanne Wincek and Renata Quintini. They're clearly students of the art of investing.

Renata started her investing career helping Stanford build up their exposure to venture capital in 2008 before joining Felicis as one of the early partners there, and then spending a few years at Lux. Roseanne built her career first at Canaan and then for 5 years at IVP. Across the half dozen firms they've worked at, its clear that both have sat back and taken a hard look at what a venture firm should be.

In fact, that's how the conversation about starting something went. When discussing the question, "how would you build a venture firm?" they were completing each other's sentences. And the answers they had to those questions are right after my own heart.

The Evolution Cycles of Venture

When venture changed the first time after the dotcom, it was largely around the cost curve of building businesses. Venture had, for so long, gone to funding assets. Semis, servers, and all that jazz. But as SaaS, mobile, and cloud computing changed the paradigm of building a business, you could start a business much more cheaply. That changed the equation from funding assets to funding distribution. Suddenly it was so much more competitive, so funding focused on helping founders get their products in front of the right people.

So the next logical question? What is the evolution of today? Roseanne and Renata articulated that, increasingly, the name of the game was executing more and more quickly. Renata articulated it this way:

"What has changed for technology companies over the last 15 years was the need to build bigger and better teams much earlier. Now, Fortune 100 buys from startups. Your markets are truly global if you have something that people want. People will not give you a pass just because you're a startup. It's not uncommon to see companies that look more like grownup businesses. The difference between [the companies] that made it and those that didn't was the ability to really scale their operations to continue to seize on the momentum."

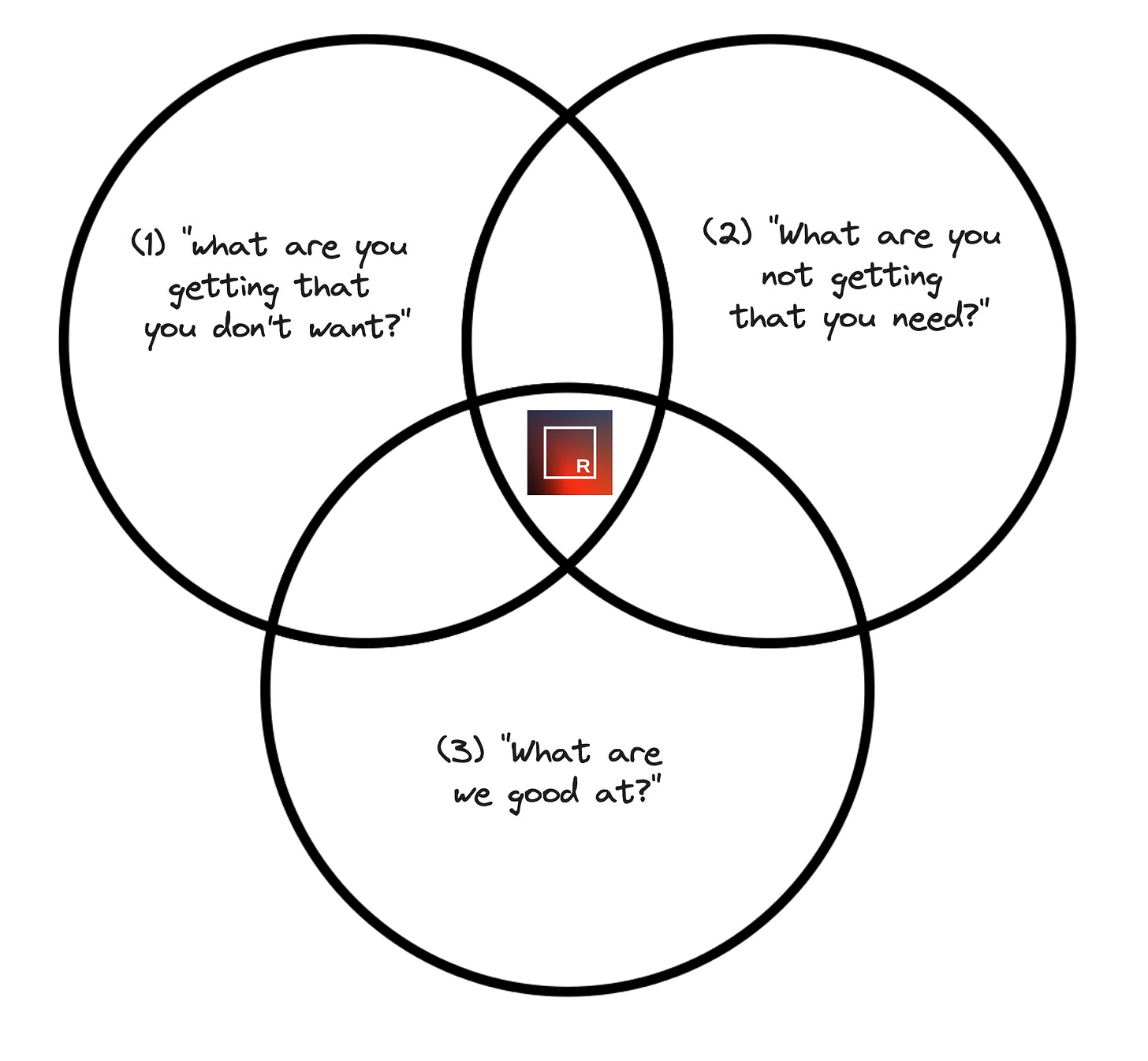

So as the team set out to create a firm to support that ability to scale, they did what any good founder would do, and did some user research. They went out and asked three questions to the founders they'd worked with, and then created a Venn diagram to understand what could drive the most value:

The result of that exercise? The emergence of a framework built around what Renegade Partners calls the "super critical stages." After closing their first fund on Friday the 13th of March 2020, the day the COVID earth stood still broke down, they set out to build in pursuit of the insights they'd uncovered.

The Innovation: Super Critical Stages

Scaling a business is just like growing up. You can't become a successful adult without establishing a pattern of success in your early years. One story I've written about before that I like is about John Quincy Adams and his relationship with his young son, George:

"Adams spent the spring and early summer practicing the law in his desultory way, reading, and seeing to George's education, as his parents had seen to his. Every morning before eight he and George took turns reading to each other four chapters of the Bible, and then father and son talked about the meaning of the passages. He showed George the countries of the world on a map. He took George to a performance of Hamlet."

Parents sometimes take for granted what their children are capable of when they're young. The same can be said of startups. Renegade Partners is built on the acknowledgement that the best businesses are those that successfully learn how to scale in the early years. Everything the firm does is built around enabling firms to create scaffolding around these critical moments.

And every company goes through multiple super critical stages, from product market fit to early hiring, and on to building a go-to-market engine. And you might think this is most valuable for a first-time founder. But that isn't the case. As Roseanne explained to me:

"It's a real Dunning–Kruger effect. Repeat founders have more humility around what they know and don't know, and how hard it is. And things are changing all the time. Even if you built a wildly successful company 5 or 6 years ago, things have still changed since then."

So armed with the knowledge that founders want a specific value prop from their investors, what has defined Renegade Partners as a firm?

Key Themes

Turning Startups Into Companies

In an interview recently, Renata was asked what was most important to the firm, and she listed two things: (1) durable business models, and (2) markets that matter. Both important ideas, but the first is something I respect immensely. Take AI for example. In the same interview, when asked whether Renegade Partners was bullish on AI, Renata had a great answer:

"Long-term, yes. Short-term? Very cautious. The amount of evolution in AI over the last two years is astounding. The amount of great founders building interesting things is unparalleled. And the amount of capital provided has created a great environment to create things. But as investors, what is going to create durable long-term value? One area is going to lie in the application layer. We're seeing great stuff done with models, but the incumbents; Google, Facebook, Microsoft, they're spending a lot of capital and have a great position to own that. So as a net new investor, that's not a space we're looking to invest in. It's very well capitalized."

This idea of responsible and sustainable business building goes hand-in-hand with helping startups scale to become "grown ups." Building with substance rather than hype. Something I just wrote about a few weeks ago.

Markets That Matter

Building sustainable companies in unsustainable markets loses a lot of the value. In my conversation with Renata and Roseanne, I asked about this idea. How do you decide which market matters? One key measure is the GDP denominator. How much of GDP does this particular market actually touch?

"Sometimes when you think about markets that feel big, when you take a step back and crunch the numbers, you realize the core market isn't as big a market as you think it is. You have to underwrite all these adjacencies and product expansions. Once you have to start justifying expansion A, B, and C, all at relatively high penetrations, it becomes harder and harder to see the real opportunity."

Instead, with the blue ocean opportunities, like global transportation, or international payments, you have these massive markets that simply require execution from businesses built to be sustainable for the long-term. That's how you leverage super critical stages to tackle meaningful markets.

Your Fund Size Is Your Strategy

Finally, a critical aspect of Renegade Partners was an acknowledgement of the adage, "your fund size is your strategy." In a world of capital agglomerators, there is an element of optionality that is preserved in having a controlled fund size.

"The one rule you don't break in venture is the power law; meaning, 'can this investment return my fund?'"

Other than that, your job is to back the best founders. As a result, Renegade Partners has remained relatively stable, with fund 1 at $100M and fund 2 at $128M. "Big enough to catalyze and lead rounds, but small enough that you're not obligated to deploy ungodly amounts of capital every time.”

What Does This Mean For Venture?

On the whole, Renegade Partners is poised for success because it began its life asking a very specific question: "Why does the world need another venture fund?"

Building momentum and then allowing that momentum to compound is critical. Building a scaffolding to enable a company to scale quickly enough to take advantage of that compounding momentum? That's super critical.

Investors are not the product. Instead, Renegade Partners have set out to build a company themselves, with their first hires being a Chief People Officer and a Head of Data Science to build out functional orgs. And while capital is a part of the product, more than anything, the firm is built around the criticality of scale. The product is enabling each special company to more effectively take advantage of that scaling capability.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

Thanks for sharing. Great to turn back on the spotlight. I do think the concept of funding momentum is very aligned to "marginal gains" if we can make a small improvement in all the critical areas they very much accumulate. Legendary VCs often build multi decade partnerships with their most successful companies and it will be interesting to see how Renegade develops. Good luck!