This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Stop me if you've heard this one before.

A frog is hanging out by a river. A scorpion comes along, and asks the frog to carry it across. But the frog is no dummy. "Listen," says the frog, "I've been around scorpions before. Y'all have a tendency to sting things." The scorpion chuckles, "Now, why would I do that? If I did that, I would drown too!" The frog is convinced by the logic, and proceeds to let the scorpion saddle up.

Half way across? The scorpion stings the frog after all. "Why would you do that?" the dying frog asks. "The scorpion looks perplexed, as it sinks into the water. "Sorry. I couldn't help it. It's in my nature."

Based on my exhaustive study of the literary significance of this story (aka skimming the Wikipedia article), I liked this interpretation the best:

"French sociologist Jean-Claude Passeron saw the scorpion as a metaphor for Machiavellian politicians who delude themselves by their unconscious tendency to rationalize their ill-conceived plans, and thereby lead themselves and their followers to ruin."

One idea I often return to is a debate on human nature; one that I came across most acutely when comparing the thinking of John Adams vs. Thomas Jefferson. There's a lot of meat on the idea so I'll just summarize it.

On the one hand, people will act in their own self-interest and should be left free to do what they want, giving unfettered power to the people (Jefferson). On the other hand, people are riddled with inadequacies and easily swayed by misaligned incentives. They need guard rails, guidance, and systems to ensure people are protected from each other and themselves (Adams).

The world of company building is no different. On the one hand, founders can be visionaries who see the future as they shape it. They can execute relentlessly and, when left to their own devices, can remake the world. On the other hand, founders are also human. And as humans they're subject to their own biases, incentives, and heuristics. Those can often lead them down a rough road.

Some Context

In case you missed it, here's some relevant news to provide context for this week’s discussion. This week, John Foley, the founder and former CEO of Peloton, announced a new company called Earnesta with a $25M Series A from Addition and True Ventures. The launch of his new D2C custom rug company comes after a pretty embattled few years running Peloton. Foley stepped down as CEO in February 2022 after seeing 87% of his net worth wiped out. As of June 2022, the company was burning $2B in cash a year to generate $3.5B of revenue (a 10% YoY decline).

Full disclosure, I was working at TCV in 2018 when they led Peloton's Series F at a $3.5B valuation. Today? Peloton's market cap is $3.3B. I'll share thoughts on Foley's new business, and some of my thinking around these kinds of Second Acts in general.

But first? I want to talk about the idea of stewardship.

What's In A Stewardship?

Capital allocation is a game of trust. First, there is capital creation. The people who actually own the money. Not on behalf of others, but they themselves generate capital. That can be as simple as a public school teacher earning their pension. Or as massive as someone bootstrapping a company to $88M in revenue and $80M in profit. That's capital creation.

Capital allocation is the act of those capital owners entrusting someone else to allocate their capital. Family offices trust fund-of-funds. Fund-of-funds trust general partners. General partners trust founders. The entire venture capital lifecycle is dependent on people trusting other people with capital.

Stewardship is the responsibility someone takes on when they agree to become a guardian of someone else's capital. General partners at venture funds have a stewardship responsibility to their LPs. Founders have a stewardship responsibility to their VCs.

Some pushback to that idea is that each participant understands the risk. 90% of startups fail, VCs know that. LPs know that. Risk management is part of the job for any capital allocator. But acknowledgment of the risk shouldn't enable capital destruction. The fact that something is risky doesn't grant a license to be irresponsible with capital. That stewardship still exists. And what do you say when people, who have destroyed significant amounts of capital, get an immediate second act?

The Sine Waves of Stewardship

WeWork

I've written before about a dramatic sine wave example of capital destruction and second chances. In case you missed the WeWork drama, here's a quick summary:

"WeWork raised $12B+ in equity and $9B+ in debt. Over $20B went into that "economic engine." Guess how much is left. $600M. They have $600M in cash on the balance sheet today. So what kind of output came from that $20B input? A business that is (1) declining in revenue growth (dropping from $3.4B to $2.5B in revenue during 2021), and (2) is still, to this day, losing $4.4B to generate that $2.5B in revenue."

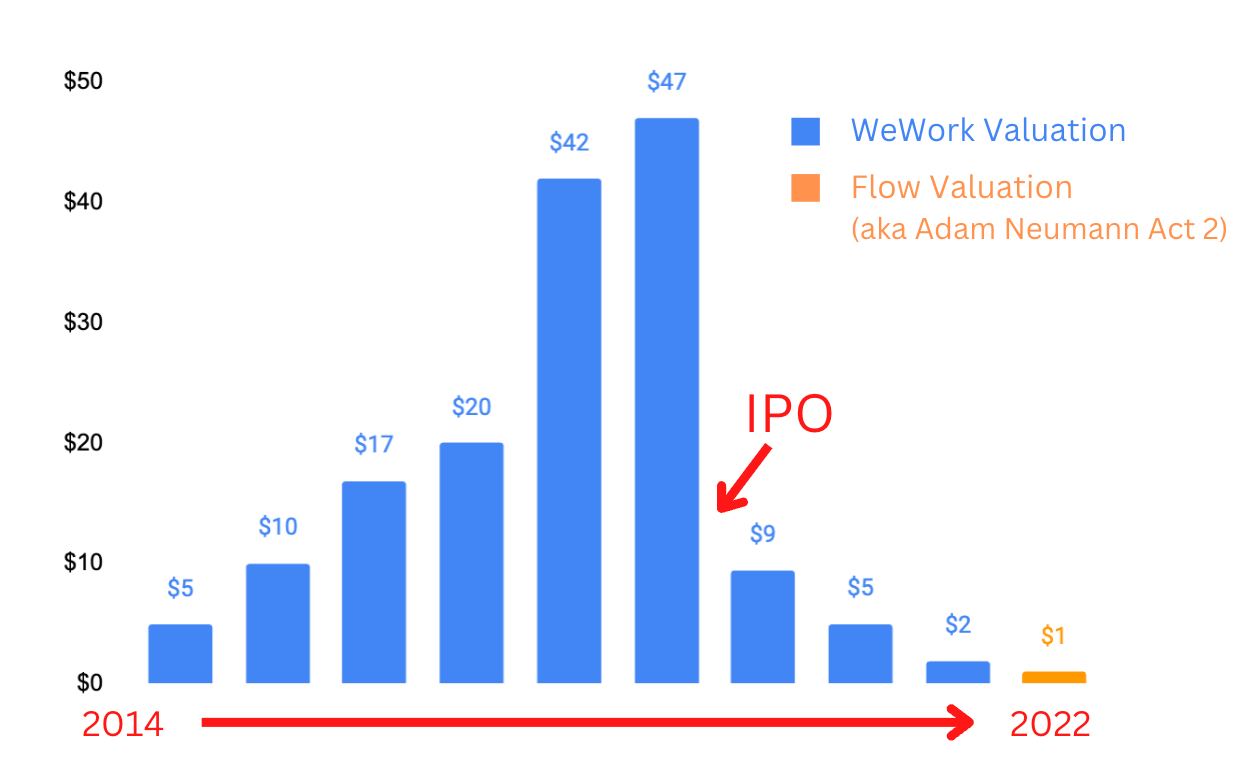

Talk about a sine wave. WeWork's valuation was a meteoric rise and fall from grace for a company that (at its core) was never materially different than a commercial real estate office company.

And see that orange speck at the far right? That's Neumann's newest company, Flow; valued at $1B before launch. If I had to articulate what some people must be feeling in a meme, it would probably be this one.

Peloton

I'd hesitate to say the excess of Peloton was the same as the insanity at WeWork because something feels fundamentally more outrageous about the WeWork story, but the number aren't far off. During COVID, Peloton rode the stay-at-home wave to a peak market cap of $50B at the beginning of 2021.

In January 2019, WeWork raised at a $47B valuation and they had ~$1.8B in revenue. At the beginning of 2021, Peloton was valued at ~$50B and had ~$2B of revenue. Not too far off. Both in the meteoric rise, and the dramatic fall.

When it comes to measuring the output of an economic engine, one metric that can shed more light than just revenue scale and growth is the cash conversion score.

In simplest terms, this is the ARR that a company is able to generate from the cash they spend over their lifecycle.

So when we reflect on these sine waves that companies like WeWork and Peloton have experienced, how do they measure up in terms of cash conversion? It's not a perfect view for a few reasons: (1) neither business really generates true ARR, and (2) we don't have a perfect view of their total amount of capital raised. But we'll take a rough look at revenue and publicly available information.

Remember with WeWork that they raised ~$12B in equity and $9B in debt, and have $600M left. That’s a total cash burn of $20.4B. Their LTM revenue is $2.9B. That’s a cash conversion score of 0.14x. Pretty rough.

Now, let's look at Peloton. From 2012 to their IPO in 2019, Peloton raised $1.1B in equity. Since IPO, they've issued $2.6B in additional equity and raised ~$1.7B in debt. Total capital raised? ~$5.4B by June 2022. They have $1.3B in cash on the balance sheet, so that's total capital used of $4.1B. Their revenue? $3.6B. That's a cash conversion score of 0.87x. Not nearly as bad as WeWork. Worse if you only count their recurring revenue of ~$1.4B. Then their cash conversion drops to 0.34x.

Peloton, WeWork, Uber, Beyond Meat. These are real businesses with real products. But their dramatic excess in terms of burn has led to quite a bit of capital destruction. Shouldn't there be some kind of reckoning when so much capital is created (other than $500M of cash from insider stock sales)?

Let's talk about John Foley's "Second Act."

The Latest Magic Carpet Ride

First, I'll say this. I started reading about John Foley's new custom rug startup expecting to be just as confused and frustrated as I was when reading about Adam Neumann's new $1B company. But I came away with a bit more appreciation for some of the framing.

Humility

First off? Foley is (at least in words) much more humble and thoughtful than Neumann, who was, instead, off "solving the housing crisis" by buying up apartment complexes with luxury dog valets and salt water pools. Here's how Foley described how he's approaching this new business:

“I am hungry, I am humbled, and I have time on my hands to do this company myself. I want to show discipline, I want to show profitability and have a real focus on unit economics."

The "Why" Behind The Investment

Secondly, this feels like a different investor scenario. Foley's company, Earnesta, raised a $25M Series A at a $100M valuation pre-launch (a far cry from Neumann's $1B.) The round was led by Addition and True Ventures, both early investors in Peloton as well.

These are different investors than a16z. Don’t get me wrong, a16z is a great firm, but they’re a very specific flavor. a16z could very well be looking at their $350M investment in Flow, at least in part, as a marketing exercise. While Lee Fixel hails from Tiger prior to starting Addition, they're far from a Tiger 2.0, at least in terms of the excess we saw from the hedge fund in 2021.

Addition is a capable firm investing thoughtfully across categories from construction to lending to AI/ML. Every time I've had the privilege to co-invest with them, I've seen that thoughtfulness first hand. So while I may not see the clear picture of the opportunity here, I have confidence that the folks at Addition weren't flying by the seat of their pants.

The Market Opportunity? Unclear

That being said, I still feel some similar hesitations about this model. Maybe Foley's focus on unit economics and profitability can play out, and have more staying power than the D2C movement of the past (RIP).

But this brings me back to the question of "should every company be a venture-backed company?" There can be some great models that don't require venture scale to be huge successes.

To his credit, Foley describes his plans as wanting to "run Ernesta more like a private equity-backed business, not one that used considerable venture and growth-equity investment to scale at all costs."

So let's look at the model a bit.

"The company will work with business-to-business partners in Georgia to source rolls of carpet in bulk, then cut them to order in a New Jersey warehouse to ship either directly or through logistics partners. By eschewing storefronts and sourcing within the U.S., Foley claimed Ernesta could reach 50% gross margins—even on its first orders when the company starts selling to customers in spring 2023."

Quite different from Peloton's 19% gross margins.

The market is estimated at ~100M rugs sold in the US each year, representing a $25B market by 2030. Foley sees the market as not needing to be "winner take all." But let's think about the company's $100M valuation. That's one end of the stick (the initial valuation). The other end of the stick that you pick up (whether you like it or not) is the outcome needed to generate a return.

If Addition wanted to see a 10x on that investment, that's $1B valuation (assuming no additional dilution, which is pretty unlikely.) The median software multiple is at ~4.5x revenue, though if we've learned anything from 2022 it’s that we've got to stop treating non-software companies like software companies. But even at that multiple, Earnesta would have to generate $220M+ in revenue.

When you look at retailers like Wayfair, Home Depot, West Elm (owned by Wiliams Sonoma), and Amazon (who are some of the largest sellers of rugs), those companies trade at ~0.5x - 2x revenue. Which means Earnesta would have to generate $500M - $2B of sales to generate that 10x return on their Series A.

If the market does grow to that ~$25B mark by 2030, you're looking at needing a 2-8% market share. Massive flooring behemoths like Mohawk Industries (mostly focused on tile, not rugs) can generate $11B of revenue, and still only have ~2% global market share.

So you have a highly fragmented market, with products that are likely to be largely commoditized, and high customer acquisition costs. Even independent of any other details, I have a hard time seeing that business working out well in the long-run as a venture-backed startup.

Second Chances

The bigger question is whether someone who spent billions in investor capital, rode a stock to the moon, sold out $100M+ in stock sales, and then left the company in disarray operationally; should that person get such an easy second bite at the apple?

The biggest pushback to this is the reality that its pretty hard to build a $1B+ revenue business. And that's true. But when your business model is selling $1 for $0.50 in revenue, that's not as hard to scale as you might expect.

What Does This Mean For Venture Capital?

Every investor, as a steward of capital, is responsible for where they put their dollars. For me? I'm not a huge fan of giving people more capital after they've demonstrated a real skill at lighting that money on fire.

Every founder, as a steward of capital, is responsible for where they decide to invest their investor's dollars as they build their business. I'm really hopeful that John Foley has learned his lesson from Peloton, and will, in fact, "show profitability and have a real focus on unit economics."

But VCs could do a better job about not just funding the known quantities, but identifying people most capable of allocating capital effectively. People who think differently, who have unique perspectives on building companies that people really need. The very best founders are, themselves, phenomenal capital allocators. The most valuable skill for a founder to have, as they scale their business, is the ability to best allocate dollars to the most valuable people, projects, and priorities.

In business building, capital allocation isn't just a VC's game. It IS the game.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

Really appreciate the simple and clear-eyed breakdown of the assumptions you need to make to hit a 10x on a business like Earnesta. Highlights how considering a few simple variables can quickly shape your thinking around “what do I have to believe?”

Really good take, Kyle.

VCs are allocating money in founders, that are allocators themselfes.