This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Death Is Only The Beginning

A few years ago a vision for the future of media was laid down. A billionaire media mogul set out to change the face of entertainment. And who would doubt him? He'd produced dozens of films with millions in the box office, won academy awards, and started one of the most successful media companies in the world.

To help him on the journey to reinvent the way people consume content he recruited a successful tech executive who had grown one of her previous companies from $4M in revenue to over $8B. The team was unstoppable.

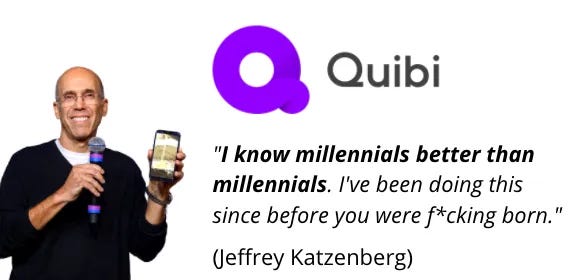

Except they weren't. They were super stoppable. Jeffrey Katzenberg and Meg Whitman raised $1.75B (billion, with a 'B'), went live for 8 months and then promptly sold Quibi's defunct library to Roku for $100M and invited all of their employees to listen to the inspirational song "Get Back Up Again" from the movie Trolls as a pick-me-up, because they were now all unemployed.

Did this failure shock the world? Are people still, to this day, scratching their heads at this failure? Not even close. People were laying out the reasons it didn't make sense even before it launched. One of the most simple reasons? Meg Whitman hates watching TV and Katzenberg seemed to... dislike his target market.

Sometimes in hindsight a failure can feel easy to diagnose. But investors put nearly $2B into Quibi. Theranos raised nearly $1B. Google Glass cost Google $895M. The kinds of investment people have made into these projects indicate the potential people saw in them at one point even if they became colossal failures. So what happened between the fanfare and the failure?

What Went Wrong?

Most people's favorite thing to do is jump up and down on a failure once the outcome appears obvious. But there is a much different approach that can make all the difference in terms of learning from failure: conducting a post-mortem.

Post-mortems came from the practice of conducting autopsies in medicine and from there the concept expanded into manufacturing, software engineering, project management, as well as within building and investing in startups. In simplest terms this is asking the question, "what went wrong?" Feels pretty simple, but there's an inherent necessity in that question.

Acknowledging that something went wrong.

That isn't always an idea everyone readily accepts. In Morgan Housel's book The Psychology of Money he makes it clear that, while many people bristle at failure its actually an unavoidable part of doing things:

"For every Amazon Prime or Orange is The New Black you know, with certainty, that you’ll have some duds. Part of why this isn’t intuitive is because in most fields we only see the finished product, not the losses incurred that led to the [successful] product.”

There are a lot of reasons people ignore the failures and the lessons to be learned. Some of it is politics, or ignorance. But for many people it can also come from a lack of imagination.

"Per Seneca: our fears are always more numerous than our dangers. Which is why we say: Failure Comes From a Failure To Imagine Failure. More things can happen than will." (Josh Wolfe)

The less time people spend with failure the less comfortable with it they become. They develop an aversion to the very concept of correction. Acknowledging that something went wrong is to acknowledge that there is blame to be dished out. Particularly in investing there is a lack of easy attribution, both for success and failure, and careers are made or broken based on an investor's ability to take credit for success and avoid association with failure.

But there's a better way. The more people can start out with a spirit of humility, execute on their investments under close observation, and reflect on them with an attitude of learning the better off they are.

Spirit of Humility

There is, unfortunately, an epidemic of people not willing to ask themselves "what am I wrong about?" This is true in politics, religion, business, marriages, and friendships. The lack of humility can be disheartening but every once in a while you catch a glimpse of genuine intellectual humility.

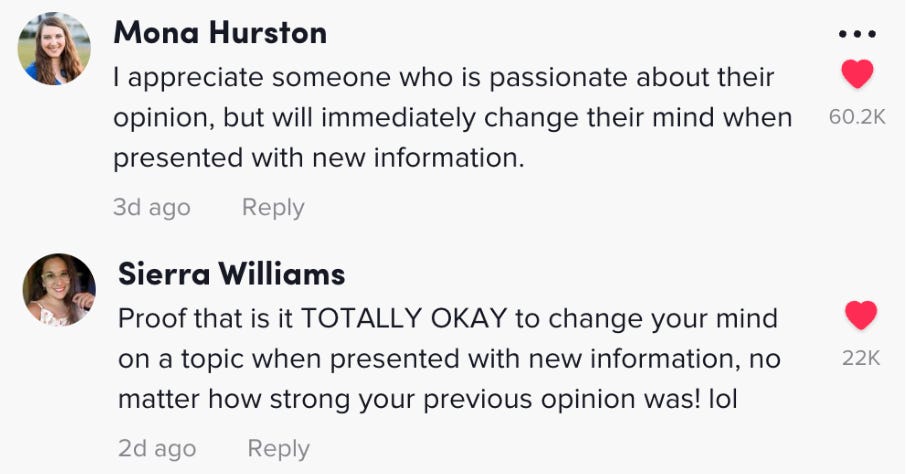

I caught one such glimpse recently when I watched a TikTok of a woman discussing her intense hatred for people who close the toilet lid after use. But when presented with the information that the lid exists to stop poo particles from spraying around the room when you flush? She experienced an abrupt awakening.

And like my good friend Rex Woodbury likes to say, "TikTok comments are the greatest window into the soul of society." There was some serious appreciation for her willingness to immediately change her mind.

Like the famous quote from John Maynard Keynes: "when the facts change I change my mind." But guess what? Nobody. Changes. Their. Mind. I am convinced that one of the single greatest blockers to social and economic progress is as simple as this: if more people changed their mind when presented with new information we would quickly have even more information with which to improve our thinking.

There are countless examples of people whose greatest driver of success was their insatiable openness to learning. David Perell gives one great example speaking of Sam Walton, the founder of Wal-Mart. In the words of one Wal-Mart associate:

"When [Sam] meets you, he looks at you—head cocked to one side, forehead slightly creased—and he proceeds to extract every piece of information in your possession. He always makes little notes.

In Walton's own words he describes his appreciation for the beauty of learning:

"It was a real blessing for me to be so green and ignorant, because it was from that experience that I learned a lesson which has stuck with me through all the years: you can learn from everybody. I didn't just learn from reading every retail publication I could get my сan hands on, I probably learned the most from studying what [my competitor] was doing across the street."

If there is one jumping off point before anyone can effectively begin to learn from their own experience it is this spirit of humility. This willingness to learn. We can talk about methods for taking notes and conducting post-mortems but its all hot air until you're ready to acknowledge opportunities to learn.

Learning As Much From Failure Or Success

Failure

Most people focus on the question I mentioned, "what went wrong." Learning from the failures. Warren Buffett and Charlie Munger are famous for their failure-focused quips:

"Our Vice Chairman, Charlie Munger, has always emphasized the study of mistakes rather than successes, both in business and other aspects of life. He does so in the spirit of the man who said: "All I want to know is where I'm going to die so I'll never go there." You'll immediately see why we make a good team: Charlie likes to study errors and I have generated ample material for him."

There is certainly logic to this where people wish they could have prevented a failure so they spend time thinking about the points of failure that could be adjusted in the future. I love reading biographies to see how successful people have thought, but they also expose a lack of adequate failure literature.

"Even though all [biographies] contain some anecdotes about setbacks, these are always embedded in a bigger story about success. Failed managers unfortunately rarely write biographies." (How To Take Smart Notes)

But learning is learning, no matter the source. And I believe as much can be learned from success as failure if you approach it the right way.

Success

In 2007 Ed Catmull gave a talk at Stanford called "Keep Your Crisis Small." As one of the founders of Pixar this was soon after he had just helped sell Pixar to Disney for $7.4B. So he had some lessons to share on learning from success.

He reflects on their experience of putting the teams involved on each film through a rigorous post-mortem. Especially when it was successful.

"The task is always to keep pushing the in-depth analysis because unless you do it you'll always go for the easy thing. When something goes right you want to bask in it and not dive deeper. So we had to change the process every single time or else people will game it. The latest thing we're doing (until it gets gamed) is asking them to pick from their process the five things they would do again, and the five things they wouldn't do again."

The Ghost of Christmas Past

Once you've embraced the spirit of humility and started to evaluate both your failures and successes you can start to think about the process behind a post-mortem. In reality every process will be different. But across the post-mortem literature there are several consistent threads to pull on.

"Dream The Nightmare" aka Conduct a Pre-Mortem

I've written before about the initial work you can do ahead of making any investment:

"When I was at Index we would include two sections in our memos that were popularized by Larry Summers. We would write about a company's "pre-parade" and "pre-mortem." Not only a "dream the dream" scenario, but a "dream the nightmare."

The "pre-mortem" is akin to Josh Wolfe's concept of "imagining failure." Laying out ahead of time both your thesis and the possible worst case scenarios forces you to imagine what could go wrong. You can then do a good job paying attention to those potential failure points throughout the project or investment.

Understand Your Optimism

At one of my prior firms I saw a (rare) example of one of my partners reflecting on an investment that failed. As he reflected on "what went wrong" over the course of a multi-year investment that ended up as a 1x return he pointed to his mistake of going into the process having "happy ears." Hearing what he wanted to hear instead of what was real.

There is a difference between "happy ears" and building intellectual optimism in what could happen as well as what went well after the fact. In his magnum opus on Optimism, Packy McCormick talked about the power of "dreaming the dream."

"I’m far more interested in answering the question, “What does the world look like if this goes right?” than in analyzing all of the reasons something might not work. Optimism is more useful than pessimism. But pessimism is more pervasive than it has a right to be. 'Cynicism is not a neutral position -- and although it asks almost nothing of us, it is highly infectious and unbelievably destructive.'"

Post-mortems aren't meant to be inherently negative. They're meant to be inherently instructive. But if you find yourself reflecting on everything you've done focused completely on the negatives then you're doing it wrong.

Keep a Journal

I've written before about the power-house of a product engine that is Amazon. One of the most effective strategies behind that engine is a focus on learning from their mistakes.

"After [negative] incidents, employees had to write a “correction of error” report, which analyzes an incident in detail and tries to get to its underlying root causes by going through a series of iterative questions and answers called “the five whys.” The memo went all the way to Bezos, describing what had happened and recommending how the process that created the problem in the first place could be fixed."

The process of keeping some kind of record of your thinking keeps you honest. In his book The Great Mental Models Shane Parrish reinforces the impact that journaling can have on your performance.

"Keeping a journal of your own performance is the easiest and most private way to give self-feedback. Journals allow you to step out of your automatic thinking and ask yourself: What went wrong? How could I do better? Monitoring your own performance allows you to see patterns that you simply couldn’t see before. This type of analysis is painful for the ego, which is also why it helps build a circle of competence. You can’t improve if you don’t know what you’re doing wrong."

Another way I've heard it put is "when performance is measured, performance improves. When performance is measured and reported, the rate of improvement accelerates." One of the best ways to measure performance is to ask questions.

Ask Questions

Like I mentioned before, any post-mortem is going to be different depending on what you're applying it to. But the underlying building blocks will almost be formed around questions. Whether that's Bezos' "five whys" or Catmull's "five things you would do again, and five things you wouldn't."

Morgan Housel wrote a great piece about asking questions. Some of those struck me as pretty effective post-mortems. "What do I desperately want to be true, so much that I think it’s true when it’s clearly not? What do I think is true but is actually just good marketing?" Those kinds of questions are reinforcing the spirit of humility and pushing you into putting your own beliefs on trial.

In all the questions you're asking the goal should be less about "who did something wrong?" and instead focus on "what went wrong?" Blameless post-mortems are the most effective way to avoid the politics that typically cloud the effectiveness of a post-mortem.

No Learning Lost

If you find yourself asking the question “how do I do a post-mortem?” you’re already halfway there. Just the desire to observe your own work and learn from the positives and negatives is something a lot of people aren’t interested in. Whether you’re trying to learn from customer churn or stock investments it's all an exercise in humility. A willingness to learn and then adjust your behavior.

The most valuable part of the exercise is doing the exercise. Don’t get caught up in the details of ‘how’ until you’ve developed the habit of just doing it. Reflection changes behavior more effectively than any program or process. So adopt that mindset with everything you do. “I know I won’t do this perfectly, so I need to do it with the attitude of doing it even better the next time I do it.” As soon as we stop learning we die.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

I am 85 and I need to do more of this.

Yep. Learning is just another word for mistake.