This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

Two years ago, my partner Will Robbins told me a story about Peter Thiel. In a New Yorker profile in 2011, Thiel made this point:

"I oscillate on the seat-belt question. The pro-seat-belt argument is that it’s safer, and the anti-seat-belt argument is that if you know that it’s not as safe you’ll be a more careful driver."

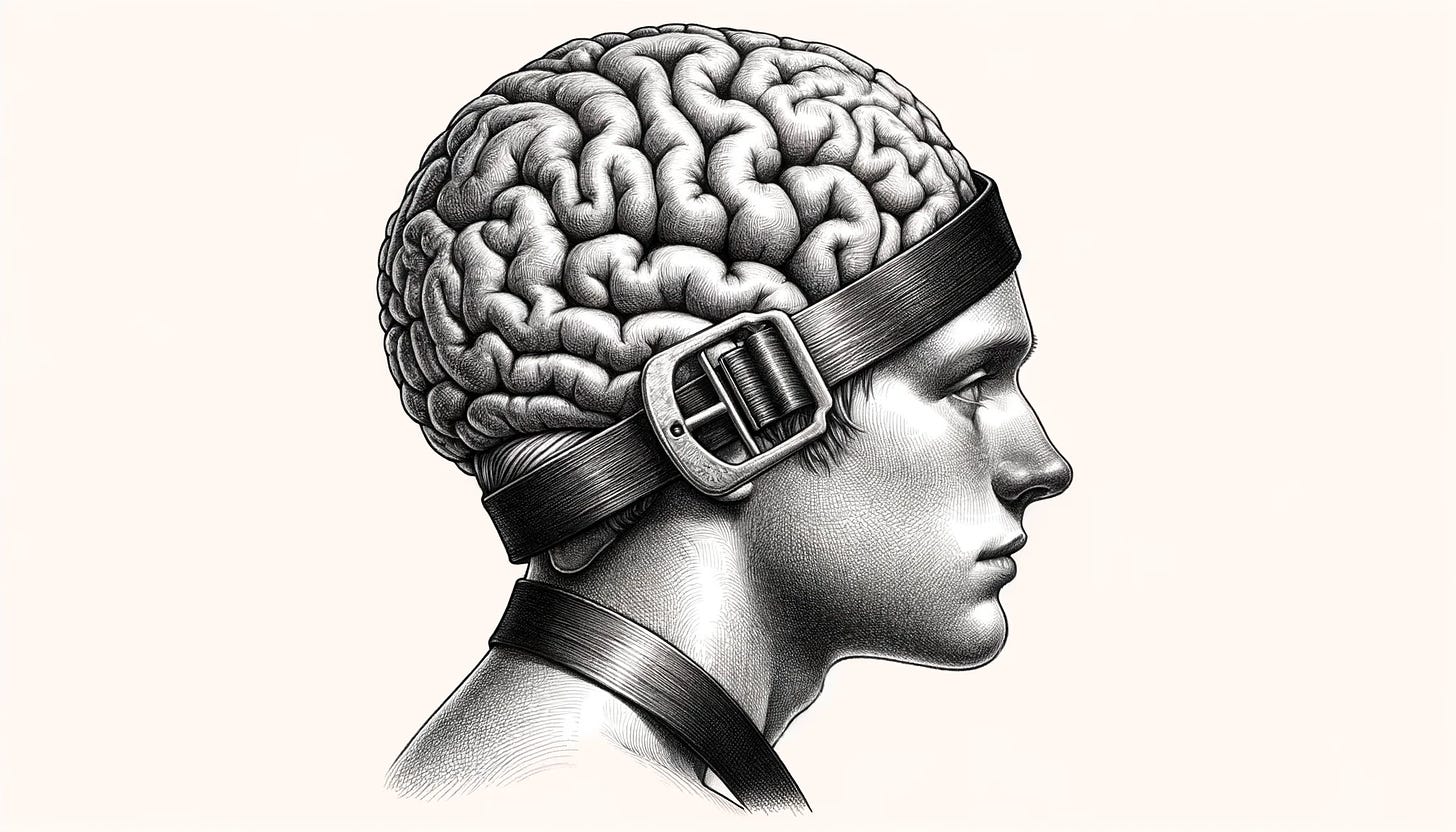

I've thought about that logic probably at least once a week since then. Not because I'm adamantly opposed to seat-belts. But because when Will and I talked about it, we spent more time talking about "intellectual seat belts," which follows the same logic.

People use establishment or in-group thinking as their "intellectual seat-belt," which makes them feel safe enough to just believe something without evaluating it themselves, leaving them to think less carefully.

This is a topic I've touched on in my writing in a bunch of different ways:

Opposed Ideas

The first, and most common, way I've framed this dynamic is with a quote from F. Scott Fitzgerald that I've quoted over, and over, and over, and over, and over, and over again:

“The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function."

The unfortunate reality is that most people struggle to hold two ideas in their head at the same time, let alone introducing any opposition between those two ideas.

Deviance

The second framework for this topic comes from Visakan Veerasamy, which I've written about before, where he refers to unsecured seat-belt-less thinking as "deviance":

"Once you have succeeded at some kind of deviant shit your ontology is permanently corrupted. You can never again trust anyone else. In 2007, Elon Musk went to Russia to negotiate with some ex-generals to buy missiles to launch a rocket and try and land it again. And all his friends were like, 'Elon, this is a stupid idea.' And he was like, 'I'm gonna do it.' And he did it. I'm not saying these are [necessarily] good people. I'm saying think about what it feels like to have everyone in your life tell you that something can't be done, and then you do it."

In-Group Short-Hands

Finally, I've also written about how people use the beliefs of their in-groups as a short-hand for their own thinking:

"So often, people trust nuanced tribal group identity and political association without any basis of first principles. I'm not Mormon, or Christian, or Republican, or a Costco member. I am a system of values and beliefs that determine how I act. Group membership should be a lagging indicator of your beliefs, not a leading indicator. When people substitute their own value system with a cookie-cutter platform from their in-group the first thing to die is nuance."

The biggest obstacle in confronting this kind of in-group thinking is best summarized by a quote from Jordan Klepper:

"So much of this is 'maybe I could convince that person.' We can have debates about what you want. You want this, I want that. Let’s compromise in the middle. That's politics. When your politics becomes who you are, we can't debate that."

Identity Beliefs

So much of the world is getting divided along dogmatically polarizing lines across incredibly nuanced topics. People are incapable of accepting any evidence contrary to what they, or their in-group, have chosen to believe. Because it’s become who they are.

If you're too afraid to confront contradictions to your beliefs, then you're not too convicted in those beliefs. In fact, I would argue the more convicted you are of your beliefs the more comfortable you are with addressing contradictions.

When being right is your identity, you will always be wrong.

When being wrong is your identity, you will endlessly pursue truth.

The Virtue of Being Wrong

There is a quote about research I love that I credit Michael Dempsey for turning me on to:

“Research is to see what everybody else has seen, and think what nobody has thought.” (Albert Szent-Gyorgi)

There should exist, I think, something similar about being wrong.

Because on the one hand, I hesitate at my own aphorism. When I say, "being wrong becomes your identity," I'm immediately confronted with things like the fact that Jim Cramer exists.

He's so wrong, so often, that it's become a popular meme that whatever he says, the opposite is true: the inverse cramer.

So no, I'm not saying "be wrong more often." We have enough of those running around.

It is, instead, the pursuit of wrongness that will bring about the pursuit of truth. Because when you do the work to figure out what isn't true, you are more likely to also find what is true.

Become Falsifiable

Often, when talking about falsifiability, religious people get uncomfortable because its a common refrain used to refute the existence of God. There are some lines of thinking I find interesting, like "What would be a fatal strike against theism for you? What could kill God?" Or the similar unfalsifiabillty of nothingness. But lets leave the metaphysics for a bit.

As it relates to the world of investing and company building, I think the pursuit of being wrong is a counter-framing to the question, "what do I have to believe?" The question should also be "in what ways am I most likely wrong?" I've written about this before when I talked about "pre-mortems."

With all of your beliefs, you are likely thinking in a less safe way because you think any number of systems, in-groups, or assumptions are keeping you safe to think what they tell you to think. That's wrong. You would be more safe if you assumed that every belief was worthy of questioning. Pursuing wrongness will pressure test any idea, whether its a belief, value, or investment.

Going back to the quote from Albert Szent-Gyorgi, “Research is to see what everybody else has seen, and think what nobody has thought.” Believing what everyone believes is like the research. I understand why people think big cap tech isn't going anywhere, why Vision Pro will fail, why vaccines are safe, why diversity and inclusion are important, and why open source is valuable. Those are the things that everyone traffics in.

But spending time "thinking what nobody has thought" is pressing for the potential points of failure. Some people take that too far, and believe that if they accept anything mainstream, they're "sheeple." But a combination of understanding mainstream, or "Lindy" ideas is valuable in identifying the potential weaknesses that expose wrongness through which your can pursue truth.

Going back to the Thiel profile, he eventually settles on a similar conclusion, when he put on his seat belt and put it this way:

“Empirically, it’s actually the safest if you wear a seat belt and are careful at the same time, so I’m not even going to try to debate this point.”

So here's my attempt at a key takeaway:

“Understand what everyone is thinking about, and then find what is actually true by understanding where that thinking could be wrong.”

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

good stuff today! thx