This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

I've written before about how movies are a big part of my personality. I have a myriad of random references hard-coded into my psychology where, sometimes, I'm surprised they're even there. That happened this week as I was thinking about the idea of value creation, and value capture. I was reminded of a particular scene.

Tom Sawyer has tricked a group of boys into thinking that painting, or whitewashing, a fence is the most fun he's had in his life, so the boys pay Tom in trinkets and treats for the privilege of painting the fence. Now, that story is straight out of Mark Twain's book, but my particular memory comes from the 1973 musical (that features 11-year old Jodie Foster).

My grandparents had the VHS tape, and I watched it a lot as a kid. Now excuse me, while I bend to the weight of my years, and endure the sweet embrace of age… Alright, moving on.

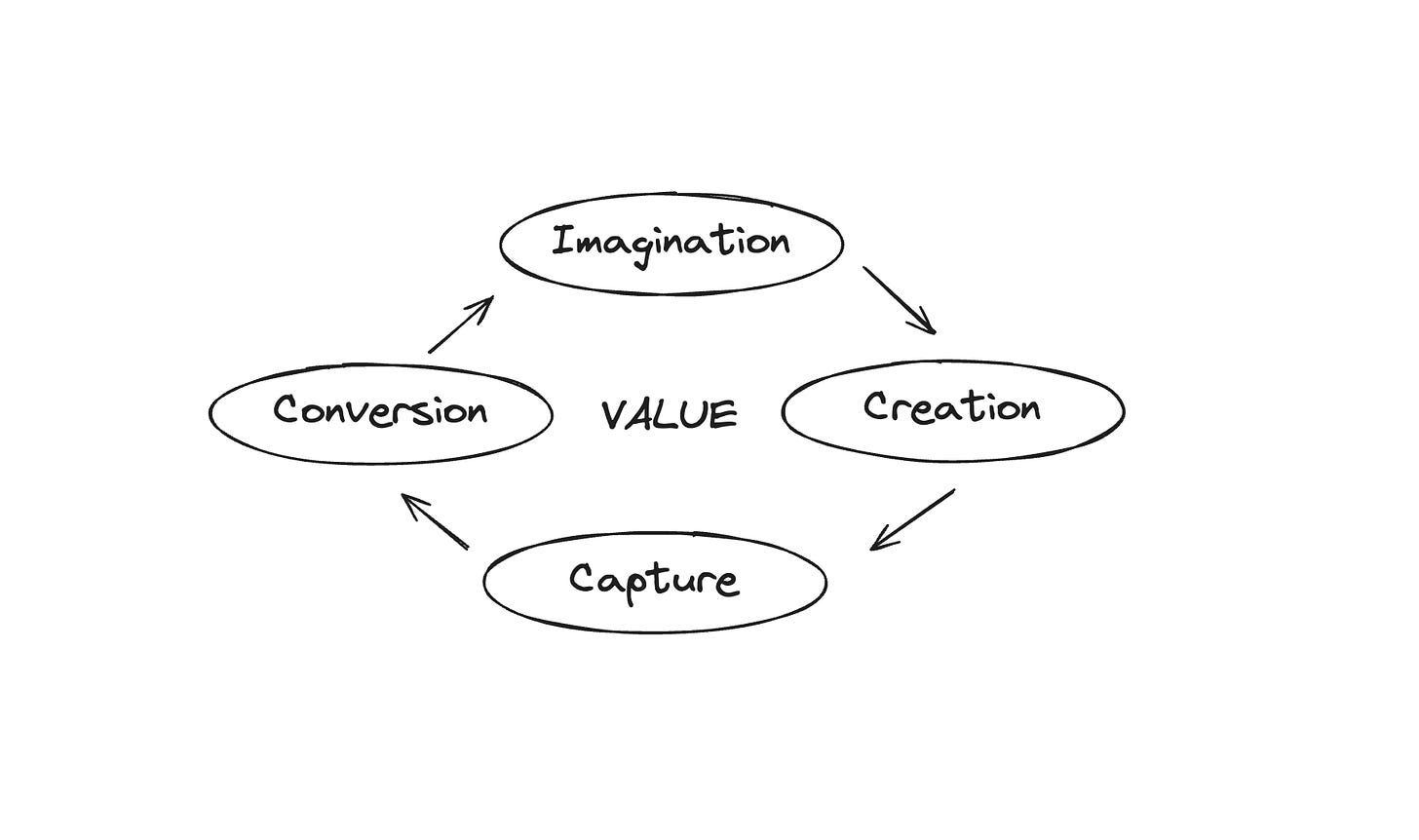

The reason I thought of this movie is because its a very specific demonstration of what I often refer to as "the Value Cycle." There are different stakeholders involved (Aunt Polly, Tom Sawyer, Ben and the boys) and each have a different relationship with value of various types:

Value Imagination: Aunt Polly dreamed up the fence being white, and the value it could provide.

Value Creation: Tom Sawyer convinced Ben and the boys that whitewashing the fence is the most fun he could have. "Does a boy get a chance to whitewash a fence every day?” Emotional value. Artificial value most would argue. But value nonetheless.

Value Capture: Tom gets not only the fence painted, but the trinkets and treats the boys pay for the privilege (we call that diversified revenue streams).

Value Conversion: Tom converted the boys pleasure at working into the satisfaction of Aunt Polly's imagined outcome.

Understanding the Value Cycle, and being able to answer which, if any, of the four you're addressing is the clearest way to articulate a business's value. The problem is that hype and value are often counter-cyclical. And in the throes of AI hype, there's never been a better time to apply the Value Cycle.

What Is Value?

I remember taking my first finance class in college, and learning about the primary principle of "maximizing shareholder value." Creating value is the primary driver of capitalism. For better, or worse, economic growth is predicated on creating value.

I've written before about how that broad stroke philosophy can be used to hide a multitude of sins. But more than that, the idea of creating value needs to be defined because value is in the eye of the beholder. Different people value different things, and every mechanism, or economic engine, needs to be set up to maximize the right value.

Value Imagination

The first piece of the cycle is letting people dream. In an ideal world, the market should be setup to make people's dreams a reality. That should be true, whether its creating a better Cheeseburger, or curing cancer. I've written several times about historical futurism, accelerationism, and inventing the future. Many of the elements of dreaming the future, and building an optimistic, utopian version of science fiction, they're rooted in value imagination.

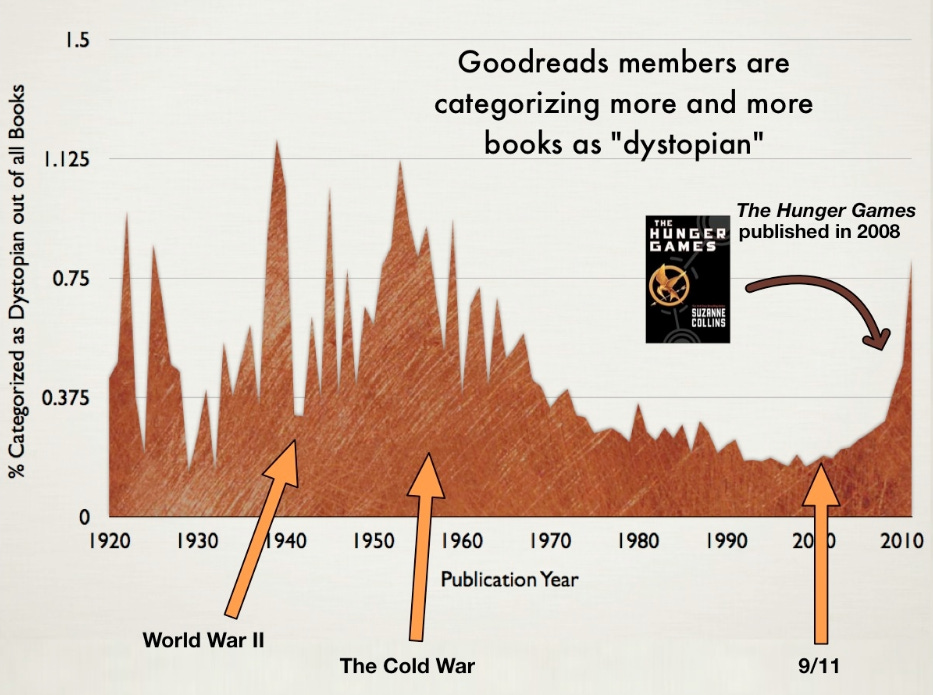

I think a lot of those efforts are in rebellion to the rise of dystopian dreaming we're seeing elsewhere. We're no strangers to dystopian nightmares in our literature. During World War II and the Cold War, there was a fertile ground for dystopian storytelling. But from the 80s to the early 2000s, we took a break from nightmares and lived a pretty good life. Then, things started to change.

Every book was a disaster story. Zombies, famine, societal breakdown. We now have a film that is trying to, as realistically as possible, articulate how the new Civil War is going to happen. People are sick of those dreams, and are desperate to find something more optimistic to hold on to.

When you think about famous stories like Henry Ford saying “If I had asked people what they wanted, they would have said faster horses," that's an example of Value Imagination. What people are dreaming of is "I'd like to go faster." Palmer Luckey has a great line that he talks about in building Anduril where they trust the customer to understand the problem, but not the solution.

Isolating the "Value Imagination" is centered around the problem. People dream up ways their lives could be better. Making their lives better is where value creation comes in.

Value Creation

The idea of Value Creation is simply putting something out into the world that has some level of usefulness to people. Think about the things in your life that make life better. From running water and electricity, to your car or TV, to Disneyland or a national park. Just about everything is a result of Value Creation.

The act of Value Creation has, in some cases, gotten a bad rap. I think this comes from the concept of Gross vs. Net Value Creation. Gross Value Creation is just taking into account every good thing that comes from a particular product or service. Net Value Creation is when you take into account the negative externalities as well. When people crap on venture capital and tech as terrible, its because they're measuring things in terms of Net Value Creation, rather than Gross.

iPhones have immense Gross Value Creation. But you get more bummed when you start to think about anti-socialization, addiction, and even the child labor leveraged to create them in the first place. Facebook, same thing. Connecting, entertaining, and informing people can have a lot of Gross Value Creation. But Net Value Creation of the service gets fuzzier.

Typically, it's too difficult to create a product or service with Net Value Creation in mind. Often, because you don't know what negative externalities will rear their head over time, or at scale. So you build the best product you can and then try to address any negative results that may come as offshoots of what you've built.

But the other problem with Value Creation goes back to the question of "value for who?" The opioid epidemic, for example, create a lot of value for the Sackler family, Purdue Pharma, and McKinsey. But it was certainly negative Net Value Creation for the the 645K+ who died of opioid overdoses, and their families. The economic incentive can muddy the waters on who value is being created for.

A better way to think about Value Creation vs. Value Capture in the Value Cycle is to distinguish the job-to-be-done vs. the economic outcomes. So if we use that framework, you can focus on the customer. Value Creation is meant to provide something useful to people. Every company, from Reddit to Tesla, is in the business of creating value for people. Some of them are just better at capturing that value than others.

Value Capture

This is where the rubber hits the road. Monetization. How are you going to make money? There can be a big divide between how much value can be created, and how much can be captured. A few weeks ago, I wrote about Wikipedia. Wikipedia is the 7th most popular website, Instagram is the 4th. However, Wikipedia typically generates ~$160M of "revenue" per year. Instagram? $60 BILLION in 2023. Different models capture value very differently.

One of the dominant methods of Value Capture over the last 15 years or so has been advertising. Google created a very specific type of value; they made the internet navigable. How did they capture that value? Running ads alongside our results.

Now, people are starting to tout AI chat tools, like Perplexity, as the “first legitimate threat to Google’s search supremacy.” Perplexity made its stance known right on its website, that search should be “free from the influence of advertising-driven models.” A line that, just within the last month, was removed from Perplexity’s site.

Why was it removed? Perplexity shared that the company would start selling ads. In fact, Perplexity’s Chief Business Officer, Dmitry Shevelenko, even said, “advertising was always part of how we’re going to build a great business.”

The need for Value Capture often ends up defining how value is created. The fear becomes that Value Capture will always mire Value Creation in sub-par value. You can't cure cancer because you make money off the ancillary services around cancer. You can't help people meet their soul mate because you need them to keep coming back to your dating app.

That's where Value Conversion comes in.

Value Conversion

In simplest terms, Value Conversion is "the act of converting one type of value or financial instrument into another type of negotiable value." But in my framework for the Value Cycle, its much more ambitious than that. Every business is meant to identify people's Value Imagination, create value to address it, and then capture some of the value that creates. But Value Conversion is the transition from a simple economic formula of Value Imagination / Creation / Capture, and instead converting that equation into a long-term sustainable economic engine.

I've written before about building a sustainable business in a piece called "Building an Actual Unicorn." In it, I shared a Twitter exchange that I love:

Source: Twitter

"A company built for all stakeholders (not just VC), and not even for shareholders) have a better chance of being great. If you truly have a great one, getting liquidity is easy." I'm a big fan of Ho Nam. One of my biggest problems with venture as an asset class is that its often arranged to build companies that are good at creating short-term liquidity as a value, but not long-term compounding value.

When you look at many of the overhyped companies in fintech, crypto, insurance, transportation, etc.; it's clear many of them weren't build to be good businesses, they were built to be exciting stories. Exciting stories are often driven by growth.

But that growth is the result of Gross Value Creation. When you account for Net Value Creation, you also have to take into account things like bad unit economics. Growth is, instead, often a function of Gross Value Creation, and minimal Value Capture. If you don't worry about the negative externalities, and you reduce the friction by not capturing value, you create exceptional growth. Bu you have no foundation for Value Conversion.

I've often quoted Bill Gurley in explaining this dynamic:

"While growth is quite important, and even though we are in a market where growth is in particularly high demand, growth all by itself can be misleading. Here is the problem. Growth that can never translate into long-term positive cash flow will have a negative impact on a DCF model, not a positive one. This is known as “profitless prosperity.”

Value Conversion? In This Economy?

Now as an illustration of the Value Cycle, let's turn to the wonderful world of AI to test our framework.

Value Imagination

Artificial intelligence has been a dream since at least the 1950s, if not earlier. Dreaming of robots and automation and flying cars; there has always been a fertile landscape for imagining the value that could come from AI. On the other side of the coin, we have just as many (if not more) dystopian nightmares, from Frankenstein's Monster to HAL 9000 or The Terminator.

But when we do what we did with Ford's "faster horse," the "dream-to-be-dreamed" is the idea of doing more with less. Automation alleviates much of the limitations we have in life, from less work to faster outcomes. There's plenty of good and bad executions of that dream, but the ability to do more with less is what most people are striving for.

Value Creation

What value has been created by AI? I've been working on a deep dive that we'll hopefully put out through Contrary Research soon about the idea of building "AI-native companies." One example we give is that AI, for a long time, was an adjacent improvement to a product or service. A bank could use machine learning to improve its fraud algorithm. But if you take away the ML, you still have a bank. You just have a worse fraud algorithm. But increasingly we're seeing companies that are AI-native, and their primary value is driven by AI.

OpenAI is probably the largest creator of value, in part because of what the "IBM effect." Just more people know about them. But from writing copy to drafting emails to responding to customer queries, and on and on. Awareness and accessible APIs has allowed OpenAI to skyrocket to $2 billion in revenue. Clearly there is value being created there.

But OpenAI is also a good example of a company who, while creating a lot of Gross Value Creation, are also gearing up to create a LOT of negative Net Value Creation. From intense lobbying, to calling for large AI models to be regulated with "the equivalent of international weapons inspectors," Sam Altman is stoking the fears of AI in a clear, unapologetic example of attempted regulatory capture. Open progress in AI models is at risk, and the centralization of power into a few players, primarily Microsoft and OpenAI, is becoming more and more likely, none of which add to positive Net Value Creation.

Value Capture

There are plenty of examples to demonstrate that, while Value Creation can cause a lot of hype and excitement, that doesn't automatically translate into a business use case that enables Value Capture. For example, AI-generated presentation startup, Tome, has reportedly struggled to find the ideal use case for its product. The company recently laid off 20% of its team as it refocuses on enterprise use cases. Despite being a hype-laden company, they’re still stumbling around trying to find a way to capture value.

Companies like Cognition Labs are valued at $2B, though they don't have revenue. Cohere, despite having raised $445M from investors, had ~$13M ARR. Does that mean they're bad businesses? Absolutely not. But it raises the bar higher and higher for how much value they need to capture to live up to the expectations that have been placed on them.

Value Conversion

The biggest question on everyone's mind is whether you can really make money from most of the AI startups being built today. Some people have been more tepid, as they reflect on the similarities between the crypto hype of 2021 and the AI hype today. For example, OpenSea peaked at $4.9B of monthly transaction volume in January 2022, before collapsing to ~$77M of monthly volume in October 2023.

Could the same thing happen in AI? We've already started to see things like ChatGPT traffic volumes plateau.

Many of the use cases for AI today are still likely propped up by experimental budgets. What does the steady state of AI spending look like? It's still obviously unclear.

But the best answer to who will convert the most value into long-term sustainable businesses will always be based in the core formula of identifying customer Value Imagination, creating a product / service to create that value, and then a mechanism to capture that value in a net positive way. Whoever can address that equation most effectively likely has the best chance to build the best business in the long-run.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

Really great. Thanks for sharing. Love the Jody Foster scene. Captures the article perfectly.

Your "movie" operating model is still serving you well!

Superb Mental Models

The ‘Value Conversion’ phrase is a game changer

Thank you for such clarity and honesty on the venture scene 🙏