This is a weekly newsletter about the art and science of building and investing in tech companies. To receive Investing 101 in your inbox each week, subscribe here:

The Calf Path

Over a decade ago I heard a poem that I think about all the time. When it comes to why we do things, it's always worth looking back at the precedent. Why do we do the things we do the way we do them?

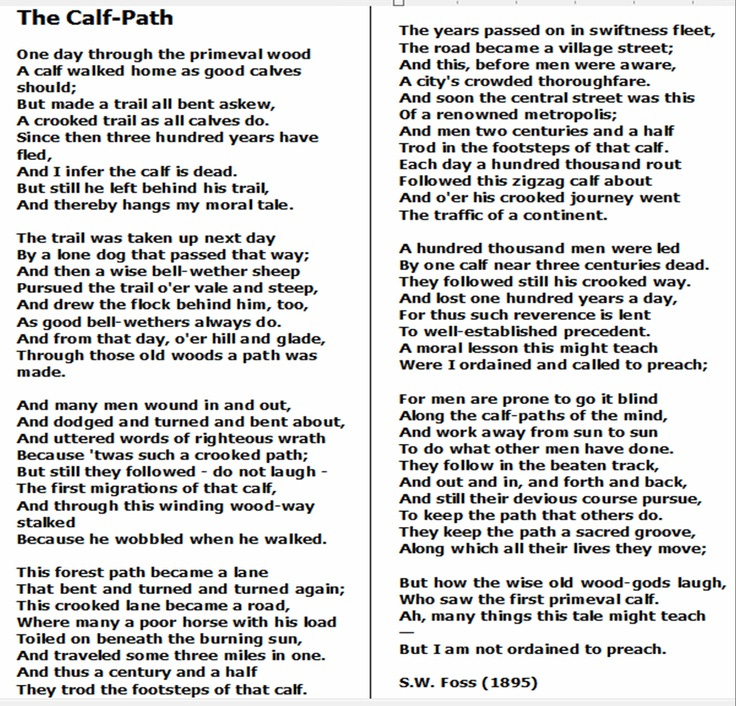

The poem is called "The Calf Path," and it sheds some light on this exact question. The full poem is below, but the TLDR is this: a calf wanders through a forest going wherever he wants, no concern for straight or narrow paths. After the calf walked his path, a dog followed suit. Afterwards, a sheep, a carriage, and one pioneer after another. Fast forward 300 years, and the calf is obviously long dead. But an entire city has built its structure around the long-gone calf's wandering path: "For thus such reverence is lent To well-established precedent. For men are prone to go it blind Along the calf-paths of the mind, And work away from sun to sun, To do what other men have done."

I've written before about this idea of why we do the things we do.

"To understand why you do something today you sometimes need only look at how it got started. Humans are creatures of habit, so a lot of times we do things in large part because that's the way we started doing them. My Dad calls it the SALY principle (Same As Last Year)."

As I reflect on a year of writing Investing 101, I'm reminded of what originally drew me to this title for my writing: Investing 101 2.0. And I'll stop you right there. No one really likes the name. It's a mouth full, and the branding is pretty confusing. I usually just shorten it to "Investing 101." Maybe some day I'll change it, but for now I came back to what intrigued me about the name.

"Reinventing the practice in the process of learning it." There is something powerful about a beginners mind where you can revolutionize something most effectively as you learn the trade (and don't kid yourself; we're all learning--especially in a transition like we've had in the last year). I've defined investing as “the art and science of allocating finite resources to create an optimal outcome.”

And a lot of my writing has covered the myriad of reasons why the pursuit of that trade could be done more effectively, especially when it comes to venture capital.

"Every investor can do a better job of thinking about each company in terms of the economic engine that they're building." (Building an Economic Engine)

"The concern is always that fundraising takes a lot of time and effort away from the founder, but the reality is both founders and investors could do a LOT better job making sure the diligence process is thorough. Even if that means taking more time, and putting more work into the process vs. just what's passable." (Diligence That's Due)

"VCs could do a much better job of deliberately identifying, executing, and measuring their value prop. And founders could do a better job of not letting their VCs off the hook. Don't just thank them for the retweet or the "way to go" response to your update email. We can do better than that." (Tales of Their Usefulness)

"I think overall we could do a better job of building companies that meet reality between the atoms and the bits. There are plenty of problems in the physical world that could benefit from digital solutions." (Rise of The Cash Man)

"Venture investors could do a better job treating startups like the more professionalized asset class they’ve become, with playbooks and processes that can be consistently evaluated." (Diligence That's Due)

"VCs could do a better job about not just funding the known quantities, but identifying people most capable of allocating capital effectively. People who think differently, who have unique perspectives on building companies that people really need." (Stewards of Capital)

"When I have conversations with VCs and I hear the frustration a lot of them have I bring this up. “I just want us all to be amazing.” Most of us want to be better than FOMO-driven heat-seekers (at least I think so.) Take the opportunity to reflect on these "dream the dream" fantasies that other VCs keep pointing out. And then see if we can't be better at what we do by making some of them a reality." (Fantasy Capital)

First? The 101.

I've quoted a great line from Walter Isaacson's biography of Leonardo da Vinci before when it comes to a beginner's mind disrupting a craft:

"The Last Supper is a mix of scientific perspective and theatrical license, of intellect and fantasy, worthy of Leonardo. His study of perspective science had not made him rigid or academic as a painter. Instead, it was complemented by the cleverness and ingenuity he had picked up as a stage impresario. Once he knew the rules, he became a master at fudging and distorting them."

Being a constant student of the world around you is one of the most effective ways to identify opportunities for change. Creativity. Evolution. Jeff Bezos is famous for his commitment to this mentality of "always being at the beginning." In his 2016 investor letter, he talked about the difference between Day 1 and Day 2 that has made up his constant appetite for experimentation:

"Staying in Day 1 requires you to experiment patiently, accept failures, plant seeds, protect saplings, and double down when you see [success]. Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

Investing is the same way. When I first told some people I wanted to frame my writing around the idea of "101," they worried it would feel "too entry level." But investing is, at its core, a game for learners.

For one thing, the world is constantly changing. We're on internet time. Many aspects of the world in 2023 would be incomprehensible to people in the 1950's. And what's more, regardless of technology, the reality of every investment decision will always be different. Investors who think of themselves as life-long learners will adjust easily. For those convinced they've already skipped ahead to Investing 102? They'll be in for a rude awakening.

Charlie Munger is considered one of the "philosopher kings" of the investing world—and he talks about learning constantly. In a 2007 commencement address at USC he talked about Confucius, and Max Planck, but one quote from Epictetus struck me:

“It is impossible to begin to learn that which one thinks one already knows.”

The art of investing often comes down to psychology. Being a master of your own mental inadequacies is the only way to avoid the endless pitfalls of foolish decisions. Forcing yourself to be a student of the world around you is the only way to constantly remind yourself of your own inadequacies. When you start to ask the question "what don't I know?," the world will willingly respond with quite a long list.

Second? The 2.0

To return to the Isaacson quote about Da Vinci, "Once he knew the rules, he became a master at fudging and distorting them." People can rarely change that which they don't understand. In that same USC commencement address, Munger has one of my all-time favorite quotes that pushes me to constantly question the things I believe:

"I feel that I'm not entitled to have an opinion unless I can state the arguments against my position better than the people who are in opposition."

I would argue that almost every disruption in any industry came as the result of a student who studied closely enough to realize when the lessons were off. Going back to my Dad's SALY principle (I say it out loud like 'Sally'). A student can dig into something like the steel industry and say, "why do we do it that way?" And the answer might be, "because that's how we did it last year." But when you dig in, you start to see cracks. "Well it was stupid last year. And just because we did it last year, doesn't mean it's less stupid to do it that way this year." That's where disruptions come from.

I've written before about the opportunities that arise from these cracks in logic. Don Valentine put it so well when it comes to the "confusion" he looked for behind the companies to back.

"One of our theories is to seek out opportunities where there's a major change. Major dislocation in the way things are. Wherever there's turmoil, there's indecision. And wherever there's indecision, there's opportunity. When it becomes obvious to anyone who reads Time magazine that it's useful to have a disk drive on a computer, then it's already too late in the cycle. So we look for the confusion when the big companies are confused. When the other venture groups are confused. That's the time to start companies."

I believe that there is similar turmoil in the world of venture capital. In 2021, that turmoil came from things moving too fast. In 2022, that turmoil came from an existential question: 'why do we do what we do?'

Many investors, to their credit, are acknowledging the great reset that could come from leaning into the "2.0," and asking harder questions. One such reflection came in Semil Shah's end-of-the-year review:

"I will look back at 2022 as a fundamental reset of everything, I’ll discard 80% of what I have learned, and I’ll lean into that feeling 10 years ago, when the future was unwritten, and I got the chance to meet and work with some of the most creative people in the world."

There exists an opportunity to change the way things get done; to improve and be better. People who mastered the "101" can start to think about the "2.0." What, if not the same way as last year, should we do instead? This requires vision. Dreaming the dream of where you want to go.

Whenever my mind wonders on to the question of "what world do I want to exist?" I think about this conversation in Alice in Wonderland between Alice and the Cheshire Cat:

"Would you tell me, please, which way I ought to go from here?"

"That depends a good deal on where you want to get to," said the Cat.

"I don't much care where--" said Alice.

"Then it doesn't matter which way you go," said the Cat.

"-so long as I get SOMEWHERE," Alice added as an explanation.

"Oh, you're sure to do that," said the Cat, "if you only walk long enough."

At least as far as I know, time only moves in one direction: forward. So time will keep walking on long enough that certainly we'll get "somewhere." But if we don't envision where we want to go, then it doesn't quite matter what we do. It doesn't matter what we do better, or if we keep doing the same thing.

Progress is most often proactive, not inevitable. We can say, "obviously, in 50 years things will be better than they are now. But will they? It took mankind 4x longer to switch from copper swords to steel swords than it did to switch from steel swords to nuclear bombs. So it got faster, but is that progress? Are we moving faster towards progress? Or apocalyptic doom? The dark ages happened, in spite of previous progress. Declines can happen. Things could get worse before they get better.

In the world building startups, I often come back to this quote from Alan Kay.

"The best way to predict the future is to invent it."

Founders are the dreamers that are thinking about the future in order to invent it. In order to improve the world around them. By the same token, everyone who has studied the 101 and is considering the 2.0 is, by definition, dreaming up the future. Long story short, investors could do a better job of disrupting themselves. Be better at funding the future.

Discussion Topics

As I set out to keep up my weekly streak of writing here, I'm considering the areas I'll write about. These are some of the things I most often find myself reflecting on:

The DNA of the greatest companies that have been built

The components of exceptional talent coming together

The magic hand of the market and the macro's engagement with the micro

Constant reflection on the world of venture capital; the players and the game

The tug-of-war betweem fiduciary returns and the risk-taking in building a better world

I'm eager to continue pushing the questions that help every investor (myself included) ask, "how can I be better?" Everyone should consider the Calf Paths their lives wander through, and then push against the biases and default modes we're so often forced to live with. Building technology companies is the realm I've decided to play in. Pushing against those norms is the more enjoyable way to live your life.

Thanks for reading! Subscribe here to receive Investing 101 in your inbox each week:

"The dark ages happened, in spite of previous progress. Declines can happen. Things could get worse before they get better." - this is an important reflection that is often overlooked.

Advancement is not inevitable.

Progress is not granted. It requires vision, impeccable execution, and luck.

The DNA of great companies being built would be a great discussion.